December 2016 Updates to North Carolina

Guidebook for Registers of Deeds, 10th Edition

is December 2016 update comprises replacement pages for 16 sections

within the 4 chapters of the manual as well as for Appendix 1 and 2. Also

included are replacement pages for the Table of Contents noting the sec-

tions that have been updated. Lowercase letters are attached to page num-

bers when a section update extends beyond the original pagination—for

example, Section 1.6.3.2 is now paginated at 29 and 29a—with blank pages

inserted as needed to retain the placement of facing pages.

To update the 2013 loose-leaf publication, remove the pages from the

binder that correspond to the pages in this update and insert in their place

the printed, trimmed, and hole-punched pages from this update. Page trim

edges and holes are marked for convenience. Pages have been formatted to

be printed on both sides of the page.

Updated sections, with their respective page numbers, are as follows:

Chapter 1

1.5.1 Maintaining an Oce ..................................20

1.6.3.2 Political Aliation .....................................29

1.6.3.3 Protected Speech ......................................30

1.9.2 Automation Enhancement and Preservation Fund .........42

Chapter 2

2.2.1.3 Birth Certicates .......................................59

Chapter 3

3.2.7.3 Common Forms of Satisfaction Instruments .............145

3.2.7.4 Adavits of Satisfaction ...............................146

3.2.10 False Lien Claims .....................................159

3.3.4.5.3 Assumed Name Certicate .............................175

3.3.4.5.9 Power of Attorney .....................................177

Chapter 4

4.1 Registers’ Role ........................................199

4.2 Capacity to Marry .....................................201

4.2.4 Gender ...............................................204

4.3.2 Application Form and Identity ..........................205

4.4.1 Marriage Ceremony ...................................209

Appendix 1. Fees

Recording Real Estate Instruments ................................217

UCC Records ...................................................217

Marriage Licenses ...............................................217

Other Records ..................................................217

Other Services ..................................................218

Appendix 2. Receipt Allocations

Deeds of Trust and Mortgages ....................................219

North Carolina

Guidebook for

Registers of Deeds

TENTH EDITION 2013

Updated December 2016

Charles Szypszak

The School of Government at the University of North Carolina at Chapel Hill works to improve the lives of

North Carolinians by engaging in practical scholarship that helps public ocials and citizens understand and

improve state and local government. Established in 1931 as the Institute of Government, the School provides

educational, advisory, and research services for state and local governments. The School of Government is

also home to a nationally ranked Master of Public Administration program, the North Carolina Judicial College,

and specialized centers focused on community and economic development, information technology, and

environmental nance.

As the largest university-based local government training, advisory, and research organization in the United

States, the School of Government oers up to 200 courses, webinars, and specialized conferences for more

than 12,000 public ocials each year. In addition, faculty members annually publish approximately 50 books,

manuals, reports, articles, bulletins, and other print and online content related to state and local government.

The School also produces the Daily Bulletin Online each day the General Assembly is in session, reporting on

activities for members of the legislature and others who need to follow the course of legislation.

Operating support for the School of Government’s programs and activities comes from many sources, includ-

ing state appropriations, local government membership dues, private contributions, publication sales, course

fees, and service contracts.

Visit sog.unc.edu or call 919.966.5381 for more information on the School’s courses, publications, programs,

and services.

Michael R. Smith, Dean

Thomas H. Thornburg, Senio r aSS ociat e De an

Frayda S. Bluestein, aSSoci ate Dean f or facult y Dev elopmen t

Johnny Burleson, aSSo ciate Dean for Dev elopmen t

Michael Vollmer, aSSo ciate Dea n for aDminiS tr at ion

Linda H. Weiner, aSSociate Dea n for operatio nS

Janet Holston, Direc tor of Strategy a nD inn ovat ion

FACULT Y

© 2013, 2016

School of Government

The University of North Carolina at Chapel Hill

Use of this publication for commercial purposes or without acknowledgment of its source is prohibited. Reproducing,

distributing, or otherwise making available to a non-purchaser the entire publication, or a substantial portion of it,

without express permission, is prohibited.

Printed in the United States of America

20 19 18 17 16 2 3 4 5 6

ISBN 978-1-56011-732-2

This publication is printed on permanent, acid-free paper in compliance with the North Carolina General Statutes.

Printed on recycled paper

Inside cover art by Charles Szypszak

Whitney Afonso

Trey Allen

Gregory S. Allison

David N. Ammons

Ann M. Anderson

Maureen Berner

Mark F. Botts

Anita R. Brown-Graham

Peg Carlson

Leisha DeHart-Davis

Shea Riggsbee Denning

Sara DePasquale

James C. Drennan

Richard D. Ducker

Robert L. Farb

Norma Houston

Cheryl Daniels Howell

Jerey A. Hughes

Willow S. Jacobson

Robert P. Joyce

Diane M. Juras

Dona G. Lewandowski

Adam Lovelady

James M. Markham

Christopher B. McLaughlin

Kara A. Millonzi

Jill D. Moore

Jonathan Q. Morgan

Ricardo S. Morse

C. Tyler Mulligan

Kimberly L. Nelson

David W. Owens

LaToya B. Powell

William C. Rivenbark

Dale J. Roenigk

John Rubin

Jessica Smith

Meredith Smith

Carl W. Stenberg III

John B. Stephens

Charles Szypszak

Shannon H. Tufts

Vaughn Mamlin Upshaw

Aimee N. Wall

Jerey B. Welty

Richard B. Whisnant

Contents

Acknowledgments xi

Chapter 1

The Oce and Its Management

1.1 Nature of the Oce 3

1.2 History of the Oce 7

1.3 Election to Oce 10

1.3.1 Qualications 10

1.3.2 Election 11

1.3.3 Vacancy in the Oce 12

1.4 Taking Oce 14

1.4.1 Oath 14

1.4.2 Bond 15

1.4.3 Ocial Seal 16

1.4.4 Notarial Powers 16

1.4.5 Restrictions 18

1.5 Register’s Employment Conditions 19

1.5.1 Maintaining an Oce (Updated 12/2016) 20

1.5.2 Compensation and Benets 21

iii— Updated 12/2016

iv | Contents—Updated 12/2016

1.6 Assistants, Deputies, and Other Oce Personnel 23

1.6.1 Positions and Appointment 24

1.6.2 Authority 25

1.6.3 Legal Restrictions on Employment Decisions 27

1.6.3.1 General Statutory Prohibitions 27

1.6.3.2 Political Aliation (Updated 12/2016) 29

1.6.3.3 Protected Speech (Updated 12/2016) 30

1.6.3.4 Employee Rights to Compensation and Benets 31

1.7 Ocial Accountability and Ethics 32

1.8 Liability 34

1.8.1 Bond 35

1.8.2 Insurance 36

1.8.3 Personal Liability 37

1.8.4 Contract Liability 38

1.9 Budgets, Fees, and Accounting 39

1.9.1 Budget 39

1.9.2 Automation Enhancement and

Preservation Fund (Updated 12/2016) 42

1.9.3 Fees 44

1.9.4 Credit Cards and Electronic Payments 46

1.10 North Carolina Association of Registers of Deeds 46

Chapter 2

Public Records and Management

2.1 Record Keeping Generally 51

2.1.1 General Record Keeping Responsibility 52

2.1.2 Disaster Preparation 54

2.2 Access to Public Records 56

2.2.1 Primary Records 58

2.2.1.1 Real Estate 58

2.2.1.2 Marriage Licenses 59

2.2.1.3 Birth Certicates (Updated 12/2016) 59

2.2.1.4 Death Certicates 61

2.2.1.5 Military Discharges 62

Contents—Updated 12/2016 | v

2.2.2 Operational Records 64

2.2.3 Internal Oce Records 64

2.2.3.1 Personnel Records 65

2.2.3.2 Legal Materials 65

2.2.3.3 Trade Secrets 66

2.2.3.4 Records Involving Public Security 66

2.3 Copies of Unrestricted Records 66

2.3.1 Copies of Single Records 67

2.3.2 Copies of Databases 68

2.4 State Vital Records Processing 69

2.4.1 Delayed Birth Registration 69

2.4.2 Amendments to Birth and Death Records 71

2.4.3 Legitimations 72

2.4.4 Verication 73

2.5 Notary Commissions 73

2.6 Grave Removals 75

2.7 Records Disposal and Archiving 76

2.7.1 General Retention Practices 76

2.7.2 Retention Requirements 77

2.7.2.1 Primary Records 79

2.7.2.2 Operational Records: Indexes 79

2.7.2.3 Internal Oce Records 80

2.7.3 Required Duplication 81

2.7.4 Destruction 83

2.8 Internet Record Redaction 83

2.9 Archived Records No Longer Recorded 85

2.9.1 County Bonds 85

2.9.2 Farm Names 86

2.9.3 Jury Lists 86

2.9.4 Stray Livestock 86

2.9.5 Timber Marks 87

vi | Contents

Chapter 3

Real Estate Instrument Registration and Indexing

3.1 Conveyances and Instruments 93

3.1.1 Conveyances 93

3.1.2 Purpose of Registration 95

3.1.3 Basic Nature of Instruments 100

3.1.4 Closings 102

3.2 Registering Real Estate Instruments 104

3.2.1 General Duty to Register Instruments Presented 104

3.2.2 Instrument Format and Required Contents 107

3.2.2.1 Nonconforming Features 107

3.2.2.2 Drafter’s Name 108

3.2.2.3 Mailing Name and Address 108

3.2.2.4 Grantor Signatures 109

3.2.2.5 Real Estate Tax Certications 110

3.2.2.6 Parcel Identier Number 111

3.2.3 Originality Requirements 111

3.2.3.1 Instruments Requiring Verication 112

3.2.3.2 Previously Recorded Instruments 114

3.2.3.3 Certied Copies 116

3.2.3.4 Electronic Filings 117

3.2.3.5 Uncertied Copies or Instruments Not

Requiring Verication 120

3.2.4 Verication 121

3.2.4.1 Authorized Ocers 123

3.2.4.1.1 NORTH CAROLINA OFFICIALS 124

3.2.4.1.2 FEDERAL AND OUTOFSTATE OFFICIALS 126

3.2.4.2 Required Elements 127

3.2.4.2.1 OFFICER’S SIGNATURE 128

3.2.4.2.2 COMMISSION EXPIRATION DATE 129

3.2.4.2.3 OFFICIAL SEAL 129

3.2.5 Payment of Recording Fees 132

3.2.6 Payment of Excise Taxes 133

3.2.6.1 Payment of the State Excise Tax 133

3.2.6.1.1 TRANSFERS SUBJECT TO TAX AND

EXCEPTIONS 133

3.2.6.1.2 AMOUNT AND COLLECTION 137

3.2.6.1.3 REFUNDS AND CORRECTIONS 139

3.2.6.2 Separate County Excise Tax 141

Contents—Updated 12/2016 | vii

3.2.7 Satisfaction Instruments 142

3.2.7.1 Nature and Function 142

3.2.7.2 Historic Methods of Satisfaction 143

3.2.7.3 Common Forms of Satisfaction Instruments

(Updated 12/2016) 145

3.2.7.4 Adavits of Satisfaction (Updated 12/2016) 146

3.2.7.5 Deeds of Release 148

3.2.7.6 Documents of Rescission 149

3.2.7.7 Register Verication and Registration 149

3.2.8 Plats 150

3.2.8.1 Permissible Plat Size and Material 151

3.2.8.2 Certication Requirements and Exceptions 152

3.2.8.3 Plats Requiring Special Treatment 155

3.2.8.3.1 HIGHWAY RIGHTOFWAY PLANS 155

3.2.8.3.2 TRANSPORTATION CORRIDOR MAPS 157

3.2.8.3.3 CONDOMINIUM PLANS 157

3.2.8.3.4 ANNEXATION MAPS 158

3.2.9 Farmland District Notices 158

3.2.10 False Lien Claims (Updated 12/2016) 159

3.3 Indexing Real Estate Instruments 160

3.3.1 Purpose and Eect of Indexing 161

3.3.2 Prompt Indexing 163

3.3.3 Structure, Contents, and Order of Index 164

3.3.4 Identifying Parties 167

3.3.4.1 Representatives 170

3.3.4.2 Subsequent Instruments 171

3.3.4.3 Spelling Discrepancies 173

3.3.4.4 Other Names for Same Party 173

3.3.4.5 Parties to Common Instruments 174

3.3.4.5.1 AFFIXING MANUFACTURED HOME NOTICE 174

3.3.4.5.2 ASSIGNMENT OF SECURITY INSTRUMENT 174

3.3.4.5.3 ASSUMED NAME CERTIFICATE

(Updated 12/2016) 175

3.3.4.5.4 BANKRUPTCY NOTICE 175

3.3.4.5.5 DEED 175

3.3.4.5.6 DEED OF TRUST 176

3.3.4.5.7 FORECLOSURE DEED 176

3.3.4.5.8 PLATS 176

3.3.4.5.9 POWER OF ATTORNEY (Updated 12/2016) 177

3.3.4.5.10 REQUEST FOR NOTICE OF FORECLOSURE 177a

viii | Contents—Updated 12/2016

3.3.4.5.11 SATISFACTION OF SECURITY INSTRUMENT 178

3.3.4.5.12 SUBSTITUTION OF TRUSTEE 178

3.3.5 Format of Index Name Entries 178

3.3.5.1 Recognized Characters 179

3.3.5.2 Components of Human Names 180

3.3.5.2.1 LANGUAGE CONVENTION 180

3.3.5.2.2 HYPHENATED SURNAME 181

3.3.5.2.3 SURNAMES IN PARENTHESES 181

3.3.5.2.4 SUFFIXES 182

3.3.5.2.5 TITLES AND DEGREES 182

3.3.5.3 Status Field 182

3.3.5.4 Estate Names 183

3.3.5.5 Trust Names 183

3.3.6 Search Aids 183

3.3.6.1 Equivalencies 184

3.3.6.2 Auto Completion 184

3.3.6.3 Soundex 185

3.3.6.4 Political Divisions 186

3.3.6.5 Words Beginning with The, A, An 186

3.3.6.6 Results and Punctuation, Symbols, and Spaces 186

3.3.7 Corrections to Index 187

3.4 Uniform Commercial Code Filings 187

3.4.1 Registration 188

3.4.2 Indexing 190

3.4.3 Information Requests 190

3.5 Torrens Law 191

3.5.1 Background and Use 191

3.5.2 Title Registration 192

3.5.3 Deeds of Trust and Other Liens and Claims 193

3.5.4 Ownership Transfers 194

3.5.5 Indemnity 195

3.5.6 Release from Registration 196

viii | Contents

Contents—Updated 12/2016 | ix

Chapter 4

Marriage Licenses

4.1 Registers’ Role (Updated 12/2016) 199

4.2 Capacity to Marry (Updated 12/2016) 201

4.2.1 Marital Status 201

4.2.2 Age Requirements 202

4.2.3 Kinship 203

4.2.4 Gender (Updated 12/2016) 204

4.2.5 Competency 204

4.3 Issuance of Marriage Licenses 204

4.3.1 Marriage License 205

4.3.2 Application Form and Identity (Updated 12/2016) 205

4.3.3 Personal Appearance 206

4.3.4 Age 207

4.3.5 Social Security Numbers 207

4.3.6 Fees 208

4.3.7 Responsibility of the Register 208

4.4 Marriage Ceremony and Record 209

4.4.1 Marriage Ceremony (Updated 12/2016) 209

4.4.2 Marriage Records 211

4.5 Delayed Marriage Certicates 213

4.6 Changes in Applications and Licenses 214

Appendix 1

Fees 217

Recording Real Estate Instruments (Updated 12/2016) 217

UCC Records (Updated 12/2016) 217

Marriage Licenses (Updated 12/2016) 217

Other Records (Updated 12/2016) 218

Other Services (Updated 12/2016) 218

x | Contents—Updated 12/2016

Appendix 2

Receipt Allocations 219

Deeds and Other Instruments (except plats, deeds

of trust, and mortgages) 219

Deeds of Trust and Mortgages (Updated 12/2016) 219

Marriage Licenses 219

Other Fees Subject to Pension and Automation Funds 220

Index 221

Updates to this edition are available

online at www.sog.unc.edu/pubs/updates.

1— Updated 12/2016

Chapter 1

The Oce and Its Management

1.1 Nature of the Oce 3

1.2 History of the Oce 7

1.3 Election to Oce 10

1.3.1 Qualications 10

1.3.2 Election 11

1.3.3 Vacancy in the Oce 12

1.4 Taking Oce 14

1.4.1 Oath 14

1.4.2 Bond 15

1.4.3 Ocial Seal 16

1.4.4 Notarial Powers 16

1.4.5 Restrictions 18

1.5 Register’s Employment Conditions 19

1.5.1 Maintaining an Oce (Updated 12/2016) 20

1.5.2 Compensation and Benets 21

1.6 Assistants, Deputies, and Other Oce Personnel 23

1.6.1 Positions and Appointment 24

1.6.2 Authority 25

1.6.3 Legal Restrictions on Employment Decisions 27

1.6.3.1 General Statutory Prohibitions 27

1.6.3.2 Political Aliation (Updated 12/2016) 29

1.6.3.3 Protected Speech (Updated 12/2016) 30

1.6.3.4 Employee Rights to Compensation and Benets 31

1.7 Ocial Accountability and Ethics 32

1.8 Liability 34

1.8.1 Bond 35

1.8.2 Insurance 36

1.8.3 Personal Liability 37

1.8.4 Contract Liability 38

1.9 Budgets, Fees, and Accounting 39

1.9.1 Budget 39

1.9.2 Automation Enhancement and

Preservation Fund (Updated 12/2016) 42

1.9.3 Fees 44

1.9.4 Credit Cards and Electronic Payments 46

1.10 North Carolina Association of Registers of Deeds 46

2 | North Carolina Guidebook for Registers of Deeds—Updated 12/2016

the foreseeable future not only for making the complete records available

and for instrument recordings that the presenter wants to handle directly

but also for the many other services that registers provide and that require

a physical presence, such as applying for a marriage license.

e board of commissioners of each county is authorized to x the

hours and days of the week during which the oce of register of deeds

must be open, and the register or one or more deputies or assistants must

be present during those hours.

68

is may include the days the oce will

be closed because of a holiday. e board, under its authority to establish

oce hours, may establish a deadline for presenting instruments earlier

than the oce’s closing time to provide the register with time to process

recordings after receipt but before shutting the doors. For example, a board

might provide that no instrument will be accepted for recording after

4:30p.m. even though the oce remains open until 5:00 p.m.

If an emergency occurs that requires closing the oce temporarily

without the commissioners’ prior approval, the register should coordi-

nate the action with the county manager including possible commissioner

ratication of the action. Registers must adhere to these operating hours

for real estate registration and may not make exceptions if someone asks

the register to stay open late or to open during other times to accept an

instrument for recording. As discussed in Chapter 3, the order of record-

ing is important for legal rights, and no one should have an advantage over

those who believe the oce will adhere to its operating hours.

1.5.2 Compensation and Benets

e salaries of the register and the register’s employees are established by

the board of county commissioners under their statutory authority to set the

salaries of all county ocers.

69

Usually the salary is set according to a posi-

tion classication and pay plan and the register and the register’s employees

participate in the county’s expense allowance and benet programs.

To protect the elected register’s independence during a term, the board

of county commissioners is prohibited from reducing an incumbent reg-

ister’s salary during the term unless the register agrees to the reduction

or the Local Government Commission orders it because of a nancial

68. G.S. 161-8; G.S. 153A-94(b).

69. G.S. 153A-92.

Chapter 1: The Oce and Its Management —Updated 12/2016 | 21

emergency.

70

To reduce the future salary of a register running for re-

election, the commissioners must by resolution give notice of intent to

do so no later than fourteen days before the last day for ling notice of

candidacy for the oce.

71

Nothing requires the county to pay a newly elected register the same

salary as the former register. Naturally, a county may dierently compen-

sate based on experience. e statutes are not explicit about whether the

board of commissioners may pay a person appointed to complete an elected

register’s term during the remainder of the term a salary lower than that

of the register being replaced. e statute prohibiting a reduction except

under certain circumstances refers to “compensation paid to an ocer

elected by the people.”

72

e statute can be reasonably interpreted as refer

-

ring to the person actually elected, not to a person appointed to com-

plete a term, in which case there would be no statutory restriction against

adjusting the salary of the appointed person. e reasonableness of such an

adjustment would be further supported if the adjustment is based on how

the appointed person ts within an established salary schedule, or, if the

county does not have such a schedule, the adjustment is based on experi-

ence and other reasonable criteria. e adjustment should be made before

the appointed person undertakes the employment.

As described in Section 1.3.3 above, the board of commissioners may

grant the register of deeds a leave of absence without pay and appoint an

acting register of deeds.

73

e board of commissioners is authorized to establish policies concern-

ing workdays and holidays for county ocials and employees.

74

Usually this

is done through a county personnel ordinance. When the employees are

made subject to the county’s personnel ordinance, the register is not, of

course, free to establish a dierent policy regarding annual and sick leave.

Registers are likely to be eligible to participate in retirement plans oered

by or through the county. e General Assembly has authorized a pension

fund to supplement local government retirement benets to attract the

70. G.S. 153A-92(b)(1).

71. G.S. 153A-92(b)(2).

72. G.S. 153A-92(b)(1) (emphasis added).

73. G.S. 128-40.

74. G.S. 153A-94(a).

22 | North Carolina Guidebook for Registers of Deeds

taking other adverse action against an employee because the employee

pursued a legally protected right, such as making a workers’ compensation

claim or disclosing truthful information reasonably believed to concern a

violation of a law or regulation.

106

An employee who believes that a decision

has been made in violation of this law may le a written complaint with the

N.C. Commissioner of Labor alleging the violation. e complaint must be

led within 180 days of the alleged violation.

107

1.6.3.2 Political Aliation

Most registers are aliated with political parties and stand for election as

a party’s nominee. When a register resigns or otherwise leaves oce before

an election, by statute the former register’s party has the opportunity to

designate the successor for the rest of the term. Despite this conspicuous

role of party politics in a register’s accession to oce, in general the regis-

ter may not re or hire employees based on their party aliation. Public

employees have a constitutional right to their own political views, including

what party they wish to support, and their employment cannot be made

conditional on party aliation, with one exception that is unlikely to apply.

Party aliation may be considered only when it is required for eective

job performance. is would exist only if the register can establish that the

employee is eectively a spokesperson for the register’s policies and is privy

to condential information in this regard.

108

As the U.S. Supreme Court

explained, “the ultimate inquiry is not whether the label ‘policymaker’ or

‘condential’ ts a particular position; rather, the question is whether the

hiring authority can demonstrate that party aliation is an appropriate

requirement for the eective performance of the public oce involved.”

109

A register’s discretion to consider political aliation in making employ-

ment decisions can be informed by cases involving the sheri’s oce. e

North Carolina Supreme Court has held that a deputy sheri is not a

county employee for purposes of this state’s statute prohibiting employ-

ment decisions based on political activity.

110

In that case the deputy alleged

that she was not reappointed to her position because she did not contribute

106. G.S. 95-240 to -244.

107. G.S. 95-242(a).

108. Branti v. Finkel, 445 U.S. 507 (1980).

109. Id. at 518.

110. Young v. Bailey, 368 N.C. 665, 781 S.E.2d 277 (2016)

Chapter 1: The Oce and Its Management —Updated 12/2016 | 29

to the sheri’s reelection campaign. e court said that under state law a

sheri “has singular authority over his or her deputies” and is considered

the employer even though the county provides the funds for the employ-

ment. e sheri’s authority includes the exclusive statutory right to hire

and re employees in the sheri’s oce, authority also given to a register of

deeds under the same statute. e court also said that sheris are entitled

to expect loyalty from their deputies, who are entrusted with condences

and may act in their sheris’ names and with their sheris’ authority.

111

e state supreme court noted with approval a North Carolina Court of

Appeals case in which the court held that a register of deeds had the same

employment authority as a sheri and was entitled to the same loyalties.

e court of appeals held that a register could “without violating the United

States and North Carolina Constitutions” dismiss his second-in-command

when she announced her plan to run against the register.

112

erefore,

the statute prohibiting certain kinds of political inuence

113

was deemed

inapplicable. Accordingly, based on these recent cases, a register of deeds

may when making employment decisions consider a deputy’s or assistant’s

political activity that is related to the oce, at least to the extent that the

register’s deputy or assistant is similar in relationship to the register as a

sheri’s deputy is to the sheri.

1.6.3.3 Protected Speech

Register assistants’ and deputies’ First Amendment rights extend to being

able to express personal views on matters of public concern in public with-

out fear of employment retaliation, but this right is limited with respect

to matters related to their jobs. e U.S. Supreme Court explained that

“the First Amendment does not prohibit managerial discipline based on

an employee’s expressions made pursuant to ocial responsibilities.”

114

As

the Court said, a restriction on speech that relates “to a public employee’s

professional responsibilities does not infringe any liberties the employee

might have enjoyed as a private citizen. It simply reects the exercise

of employer control over what the employer itself has commissioned or

created.”

115

Accordingly, for example, a register may prohibit an employee

111. G.S. 153A-103(1).

112. Sims-Campbell v. Welch, 769 S.E.2d 643 (N.C. Ct. App. 2015).

113. G.S. 153A-99(e).

114. Garcetti v. Ceballos, 547 U.S. 410, 424 (2006).

115. Garcetti, 547 U.S. 410.

30 | North Carolina Guidebook for Registers of Deeds—Updated 12/2016

from making o-duty public statements about register operations but not

about tax rates, presidential candidate preferences, or school board poli-

cies. Of course, registers may restrict activities while on duty to the extent

reasonably necessary for oce functioning.

G.S. 51-5.5(b) provides: “Every assistant register of deeds and deputy

register of deeds has the right to recuse from issuing all lawful marriage

licenses under this Chapter based upon any sincerely held religious objec-

tion. Such recusal shall be upon notice to the register of deeds and is in

eect for at least six months from the time delivered to the register of

deeds. e recusing assistant or deputy register may not issue any marriage

license until the recusal is rescinded in writing. e register of deeds shall

ensure for all applicants for marriage licenses to be issued a license upon

satisfaction of the requirements as set forth in Article2 of this Chapter.”

is election is not limited to any particular religion or religious practice

and applies to assistants and deputies, not to registers. If the right is exer-

cised it applies to “issuing all lawful marriage licenses” and is irrevocable

for six months. It remains in eect after the six months until the assistant

or deputy rescinds it in writing. e law does not require that the assistant

or deputy be excused or refrain from other aspects of managing marriage

records. e law is unclear about whether an election not to issue marriage

licenses is a matter of public record. Given this uncertainty a reasonable

approach would be to treat any information about the electing deputy’s

or assistant’s election as part of the condential personnel record under

G.S.153A-98 until the law has been otherwise claried either through

legislation or judicial decision. Although the law does not explicitly say that

the election may be in writing, a reasonable interpretation is that a register

may require a signed notice in order to make a record of the election. If it is

required it would appropriately contain a declaration that the assistant or

deputy is electing not to issue any marriage licenses for at least six months,

that this election is based on a “sincerely held religious objection,” and the

date of the election.

Chapter 1: The Oce and It’s Management —Updated 12/2016 | 30a

This page intentionally left blank

1.6.3.4 Employee Rights to Compensation and Benets

e laws regarding employee compensation and benets are complex and

can be surprising. ey often change. Registers should consult with county

human resources managers to be aware of requirements and restrictions

that may apply to employment practices or decisions. Counties typically

have policies in place for other county employees to ensure compliance,

and following the same policies is therefore likely also to ensure compli-

ance within the register of deeds oce. Only a brief summary of some of

the important laws is possible here.

e federal Fair Labor Standards Act (FLSA)

116

requires a minimum wage

to be paid, which includes time-and-a-half pay or compensatory time o for

hours worked after forty in a week. e overtime pay requirements do not

apply to elected registers and may not apply to an employee who is paid on a

salary basis and has executive or signicant managerial responsibilities. e

ADA, discussed above, may require accommodations for employees with

disabilities. e federal Family and Medical Leave Act (FMLA)

117

requires

up to twelve weeks of unpaid leave per year for childbirth, for a serious

health condition, or to care for a family member with a serious health condi-

tion. Entitlement to leave arises with the birth of a child for care within one

year of birth; for care upon adoption or foster care within one year of place-

ment; for care of the employee’s spouse, child, or parent who has a serious

health condition; for a serious health condition that makes the employee

unable to perform the essential functions of his or her job; and for any

qualifying exigency arising out of the fact that the employee’s spouse, son,

daughter, or parent is a covered military member on active duty. Additional

requirements apply to a covered service member with a serious injury or

illness if the eligible employee is the service member’s spouse, son, daughter,

parent, or next of kin.

118

116. 29 U.S.C.A. §§ 201–219 (1998 & Supp. 2012).

117. 29 U.S.C.A. §§ 2601–2654 (2009 & Supp. 2012).

118. 29 U.S.C.A. §§ 621–634 (2008 & Supp. 2012).

Chapter 1: The Oce and It’s Management —Updated 12/2016 | 31

1.7 Ocial Accountability and Ethics

As public ocials, registers of deeds are accountable to the people of North

Carolina for executing their duties faithfully and honestly. It is a Class 1

misdemeanor for a register to fail “to perform any of the duties imposed

or authorized by law,” and the potential penalties include removal from

oce.

119

It is also a Class 1 misdemeanor for a register to “fail, neglect or

refuse to make, le, or publish any report, statement or other paper, or to

deliver to his successor all books and other property belonging to his oce,

or to pay over or deliver to the proper person all moneys which come into

his hands by virtue or color of his oce.”

120

Registers are subject to other restrictions and prohibitions in their con-

duct that apply to public ocials generally. e N.C. Constitution pro-

vides that funds raised through taxation may be used “for public purposes

only.”

121

e N.C. Supreme Court instructed that “for a use to be public

its benets must be in common and not for particular persons, interests,

or estates; the ultimate net gain or advantage must be the public’s as con-

tradistinguished from that of an individual or private entity.”

122

In most

cases there is no question that a proposed purpose, such as personnel costs

and costs of operations, is public. But in a modern environment, a wide

variety of less obviously public expenses are incurred in connection with

such things as educational programs and consultation with other ocials

and policy makers. Expenses for participation in educational programs

and associational activities related to the registers’ oces are appropriate

for registers and their employees. is includes participation in the North

Carolina Register of Deeds Association, which is described in Section 1.10

below. Although each register’s participation and support of individual ini-

tiatives may vary, the law recognizes that each county has an appropriate

role in an association of this nature.

123

For instance, each county benets

from its register’s participation in statewide policy initiatives. Expenses

119. G.S. 14-230, -231, -241.

120. G.S. 161-27; G.S. 14-231.

121. N.C. Const. art. V, § 2(1).

122. Martin v. N.C. Hous. Corp., 277 N.C. 29, 43, 175 S.E.2d 665, 673 (1970).

123. Horne v. Chan, 62 N.C. App. 95, 302 S.E.2d 281 (the N.C. Court of Appeals

upheld the appropriateness of county and city expenditures for a reception for state

and local ocials, noting that local ocials have a duty to represent their constituents

in inuencing state policy), a ’d 309 N.C. 813, 309 S.E.2d 239 (1983).

32 | North Carolina Guidebook for Registers of Deeds

set aside annually and placed in a nonreverting Automation

Enhancement and Preservation Fund, the proceeds of which

shall be expended on computer or imaging technology and

needs associated with the preservation and storage of public

records in the oce of the register of deeds. Nothing in this

section shall be construed to aect the duty of the board of

county commissioners to furnish supplies and equipment to

the oce of the register of deeds.

154

Fees “collected pursuant to G.S. 161-10” to which the 10 percent retention

requirement applies include all fees retained by the county for real estate

instrument recording, marriage licenses, vital record fees, and other fees

but do not include what the register collects for forwarding to the state,

nor do they include excise taxes. As the statute provides, the percentage

retained is separately calculated for fees for deeds of trust and mortgages.

is statute was intended to ensure that a portion of the register’s

receipts be available for the implementation and maintenance of technolo-

gies supporting the register’s functions. It does not give specic direction

about how this fund interrelates with other county funds necessary for

the register’s budget. e statute’s intent clearly would be violated if the

AEPF amount were merely blended into the county’s general fund and

applied indiscriminately to general county expenditures. Although the

statute does not require that funds be collected for more than one year, the

logic of a non-reverting fund is to address a register’s need to accumulate

funds from year to year for expenses that cannot be met from the recur-

ring operating budget.

e AEPF earmark for “needs associated with the preservation and stor-

age of public records” is broad. Information technology has since become

central to register operations, with demands not only for imaging and data

processing but now also for Internet facilities to enable online access and

ling. To honor the statutory intent and to fulll the register’s and the

county’s responsibilities to county citizens, the register and the county

nance ocer should work together to develop a multiyear technology

plan that includes how the fund is to be applied. e AEPF is a tool for

ensuring that resources are accumulated and made available for upgrades

and enhancements that require more than the usual operating budget

allocation.

154. G.S. 161-11.3.

Chapter 1: The Oce and Its Management | 43

e county can account for the AEPF, tracking the additions and with-

drawals, as a reserve in the general fund or as a special revenue fund. e

balance of the AEPF can be invested to earn interest. Like interest on any

other fund, the interest earned from the AEPF is tied to the AEPF and must

be used only for its purposes. As a recommended best practice, for greater

transparency and ease in tracking and reporting, the county should con-

sider showing the AEPF on its own separate page within the county budget.

e AEPF does not have to be balanced annually; the funds’ nonreverting

nature allows registers to accumulate a fund balance to pay for large capital

expenses that likely would not be funded through the annual operating

budget. Neither does the statute require that the funds accumulate from

year to year. e county should consider showing the year-end fund bal-

ance for the previous ve years to show the change in fund balance over

time.

43a | North Carolina Guidebook for Registers of Deeds —Updated 12/2016

This page intentionally left blank

1.9.3 Fees

e recording fees charged by registers are prescribed by the Uniform Fee

Schedule in G.S. 161-10, which covers all real property instruments as well

as a variety of services performed by the oce (see Appendix 1). e reg-

ister may not impose dierent or additional fees or charges that are not

authorized by the statute. e statute makes no exception from the fee

requirements for instruments registered by other county or governmental

oces or by nonprot organizations.

An exact amount is specied for almost all services. For services not

specied, the statute provides as follows: “For performing miscellaneous

services, such as faxing documents, providing laminated copies of docu-

ments, expedited delivery of documents, and similar services, the cost of

the service.”

155

is enables registers to recover the costs of providing a

service that is not specically addressed with a fee, which may vary some-

what from county to county. To justify the amount of a miscellaneous fee,

a register should be able to show a rough calculation based on the actual

costs of providing a service. e statute does not exclude consideration of

personnel costs that can be directly tied to the service.

All fees must be collected before an instrument is recorded or any other

service is performed.

156

A register cannot accept a recording if less than the

full amount is paid and is not obliged to accept checks with overpayments

from which an amount is refunded from the register’s account. A register

is not authorized to allow presenters to maintain charge accounts for which

statements are later mailed periodically. A register may enable presenters

to keep prepaid accounts from which the register deducts fees as they are

incurred, because this is the equivalent of payment in cash.

Registers are responsible for the handling of all funds they receive, and

they must ensure that receipts are deposited into the appropriate accounts.

Fees and excise taxes are deposited into the county general fund except

as otherwise allocated by statute. Portions of fees and excise taxes that

are payable to the state are deposited according to the instructions of the

State Treasurer and likely handled through the county nance director.

Allocations include a portion of instrument recording fees for use in state

accounts

157

and a portion of marriage license fees for state funds related to

155. G.S. 161-10(a)(19).

156. G.S. 161-10(c).

157. G.S. 161-11.5.

44 | North Carolina Guidebook for Registers of Deeds

49— Updated 12/2016

Chapter 2

Public Records and Management

2.1 Record Keeping Generally 51

2.1.1 General Record Keeping Responsibility 52

2.1.2 Disaster Preparation 54

2.2 Access to Public Records 56

2.2.1 Primary Records 58

2.2.1.1 Real Estate 58

2.2.1.2 Marriage Licenses 59

2.2.1.3 Birth Certicates (Updated 12/2016) 59

2.2.1.4 Death Certicates 61

2.2.1.5 Military Discharges 62

2.2.2 Operational Records 64

2.2.3 Internal Oce Records 64

2.2.3.1 Personnel Records 65

2.2.3.2 Legal Materials 65

2.2.3.3 Trade Secrets 66

2.2.3.4 Records Involving Public Security 66

2.3 Copies of Unrestricted Records 66

2.3.1 Copies of Single Records 67

2.3.2 Copies of Databases 68

2.4 State Vital Records Processing 69

2.4.1 Delayed Birth Registration 69

2.4.2 Amendments to Birth and Death Records 71

2.4.3 Legitimations 72

2.4.4 Verication 73

2.5 Notary Commissions 73

2.6 Grave Removals 75

2.7 Records Disposal and Archiving 76

2.7.1 General Retention Practices 76

2.7.2 Retention Requirements 77

2.7.2.1 Primary Records 79

2.7.2.2 Operational Records: Indexes 79

2.7.2.3 Internal Oce Records 80

2.7.3 Required Duplication 81

2.7.4 Destruction 83

2.8 Internet Record Redaction 83

2.9 Archived Records No Longer Recorded 85

2.9.1 County Bonds 85

2.9.2 Farm Names 86

2.9.3 Jury Lists 86

2.9.4 Stray Livestock 86

2.9.5 Timber Marks 87

50 | North Carolina Guidebook for Registers of Deeds

which the information on the certicate is pertinent. A register

may rely on an attorney’s reasonable representation in this regard.

• An authorized agent, attorney, or legal representative of any of the

above

29

A uniform fee is set for a certied copy of a birth certicate, which

the register can waive for a copy provided to someone over the age of

sixty-two.

30

e register’s birth certicate records are only for births led through

this state’s vital records system. ey are not for birth records that some-

one in the public may wish to record, though nothing prohibits recording

birth certicates in the real estate records provided the appropriate fees

are paid. If someone presents a document for recording in the real estate

records that is unattached to a real estate document, purports “to impact

an ocial record of birth,” and is not a record led within the state’s o-

cial system, G.S. 161-14.02 directs the register to mark the rst page of

that purported birth record as follows: “THIS DOCUMENT IS NOT AN

OFFICIAL BIRTH RECORD.”

2.2.1.4 Death Certicates

Death certicates are important evidence for handling the aairs of a

deceased person, including for making funeral and burial arrangements.

ey are important for ling a probate action to handle the deceased’s

property, for showing the passage of real estate held jointly or in common,

for access to bank accounts, for claims on life insurance, and to establish

other legal rights. e government uses death certicates to track those

who were responsible for child or spousal support. e information in

death certicates also is used for collecting data on causes of death and

other health trends.

e data for a death certicate is provided by a funeral director or other

person who rst assumes custody of a body, with medical information pro-

vided by a physician or other authorized medical practitioner or ocer.

31

A

death certicate must be led with the local vital records registrar within

29. G.S. 130A-93(c), (g); G.S 130A-99.

30. G.S.161-10(a)(8).

31. G.S. 130A-112; G.S. 130A-115.

Chapter 2: Public Records and Management —Updated 12/2016 | 61

ve days after the death, and the registrar must transmit the certicate to

the register within seven days of receipt.

32

Anyone may obtain an uncertied copy of a death certicate. Only the

following persons may obtain certied copies of these records:

• e subject of the record (unless the person claiming to be the

subject is deceased according to the records)

• e subject’s spouse, parent, direct ancestor or descendant,

stepparent or stepchild, brother or sister

• A person seeking legal determination of personal or real property

rights. e statute does not further explain who meets this

32. G.S. 130A-97(5); G.S. 130A-115.

61a | North Carolina Guidebook for Registers of Deeds

This page intentionally left blank

description. A reasonable interpretation is that it includes an

attorney of record in litigation, such as a probate case, in which the

information on the certicate is relevant. A register may rely on an

attorney’s reasonable representation in this regard.

• An authorized agent, attorney, or legal representative of any of the

above

33

• A funeral director or funeral service licensee

34

Fees for certied copies of death certicates are set by statute.

35

Also by

statute, the N.C. Department of Administration is entitled to “the requested

number of certied copies” of local public records without charge when

needed to assist veterans or their beneciaries in obtaining benets.

36

e

department’s Division of Veteran’s Aairs normally makes these requests,

but they also are sometimes made on behalf of the division by a local vet-

eran’s aairs representative.

2.2.1.5 Military Discharges

Military discharge records commemorate service to the country and pro-

vide documentary evidence of qualication for veterans’ benets. ese

records are kept by the National Archives and Records Administration

(NARA), which is the ocial repository for records of military personnel

who have been discharged from the U.S. Marine Corps, Navy, Air Force,

Army, and Coast Guard. e form most commonly used for veterans’ pur-

poses is the DD Form 214, Report of Separation. is form includes infor-

mation about such things as dates of service, last duty assignment and rank,

military specialty, and medals and awards. Veterans and their next of kin

can quickly obtain this form from NARA without charge.

37

e option of

ling a copy with the service member’s county register of deeds oce is

oered as a convenience.

ere is no restriction on public access to copies of military discharge

records that have been on le for more than eighty years. By statute, access

33. G.S. 130A-93(c), (g); G.S. 130A-99.

34. G.S. 130A-93(c), (c1).

35. G.S. 161-10(a)(8).

36. G.S. 165-11(a).

37. Instructions and forms for obtaining military discharge records from

the NARA are available at www.archives.gov/veterans/military-service-records/

about-service-records.html.

62 | North Carolina Guidebook for Registers of Deeds—Updated 12/2016

89

Chapter 3

Real Estate Instrument Registration

and Indexing

3.1 Conveyances and Instruments 93

3.1.1 Conveyances 93

3.1.2 Purpose of Registration 95

3.1.3 Basic Nature of Instruments 100

3.1.4 Closings 102

3.2 Registering Real Estate Instruments 104

3.2.1 General Duty to Register Instruments Presented 104

3.2.2 Instrument Format and Required Contents 107

3.2.2.1 Nonconforming Features 107

3.2.2.2 Drafter’s Name 108

3.2.2.3 Mailing Name and Address 108

3.2.2.4 Grantor Signatures 109

3.2.2.5 Real Estate Tax Certications 110

3.2.2.6 Parcel Identier Number 111

3.2.3 Originality Requirements 111

3.2.3.1 Instruments Requiring Verication 112

3.2.3.2 Previously Recorded Instruments 114

3.2.3.3 Certied Copies 116

3.2.3.4 Electronic Filings 117

3.2.3.5 Uncertied Copies or Instruments Not

Requiring Verication 120

3.2.4 Verication 121

3.2.4.1 Authorized Ocers 123

3.2.4.1.1 NORTH CAROLINA OFFICIALS 124

3.2.4.1.2 FEDERAL AND OUTOFSTATE OFFICIALS 126

3.2.4.2 Required Elements 127

3.2.4.2.1 OFFICER’S SIGNATURE 128

3.2.4.2.2 COMMISSION EXPIRATION DATE 129

3.2.4.2.3 OFFICIAL SEAL 129

3.2.5 Payment of Recording Fees 132

3.2.6 Payment of Excise Taxes 133

3.2.6.1 Payment of the State Excise Tax 133

3.2.6.1.1 TRANSFERS SUBJECT TO TAX AND

EXCEPTIONS 133

3.2.6.1.2 AMOUNT AND COLLECTION 137

3.2.6.1.3 REFUNDS AND CORRECTIONS 139

3.2.6.2 Separate County Excise Tax 141

3.2.7 Satisfaction Instruments 142

3.2.7.1 Nature and Function 142

3.2.7.2 Historic Methods of Satisfaction 143

3.2.7.3 Common Forms of Satisfaction Instruments

(Updated 12/2016) 145

3.2.7.4 Adavits of Satisfaction (Updated 12/2016) 146

3.2.7.5 Deeds of Release 148

3.2.7.6 Documents of Rescission 149

3.2.7.7 Register Verication and Registration 149

3.2.8 Plats 150

3.2.8.1 Permissible Plat Size and Material 151

3.2.8.2 Certication Requirements and Exceptions 152

3.2.8.3 Plats Requiring Special Treatment 155

3.2.8.3.1 HIGHWAY RIGHTOFWAY PLANS 155

3.2.8.3.2 TRANSPORTATION CORRIDOR MAPS 157

3.2.8.3.3 CONDOMINIUM PLANS 157

3.2.8.3.4 ANNEXATION MAPS 158

3.2.9 Farmland District Notices 158

3.2.10 False Lien Claims (Updated 12/2016) 159

3.3 Indexing Real Estate Instruments 160

3.3.1 Purpose and Eect of Indexing 161

3.3.2 Prompt Indexing 163

3.3.3 Structure, Contents, and Order of Index 164

90 | North Carolina Guidebook for Registers of Deeds—Updated 12/2016

3.3.4 Identifying Parties 167

3.3.4.1 Representatives 170

3.3.4.2 Subsequent Instruments 171

3.3.4.3 Spelling Discrepancies 173

3.3.4.4 Other Names for Same Party 173

3.3.4.5 Parties to Common Instruments 174

3.3.4.5.1 AFFIXING MANUFACTURED HOME NOTICE 174

3.3.4.5.2 ASSIGNMENT OF SECURITY INSTRUMENT 174

3.3.4.5.3 ASSUMED NAME CERTIFICATE

(Updated 12/2016) 175

3.3.4.5.4 BANKRUPTCY NOTICE 175

3.3.4.5.5 DEED 175

3.3.4.5.6 DEED OF TRUST 176

3.3.4.5.7 FORECLOSURE DEED 176

3.3.4.5.8 PLATS 176

3.3.4.5.9 POWER OF ATTORNEY (Updated 12/2016) 177

3.3.4.5.10 REQUEST FOR NOTICE OF FORECLOSURE 177a

3.3.4.5.11 SATISFACTION OF SECURITY INSTRUMENT 178

3.3.4.5.12 SUBSTITUTION OF TRUSTEE 178

3.3.5 Format of Index Name Entries 178

3.3.5.1 Recognized Characters 179

3.3.5.2 Components of Human Names 180

3.3.5.2.1 LANGUAGE CONVENTION 180

3.3.5.2.2 HYPHENATED SURNAME 181

3.3.5.2.3 SURNAMES IN PARENTHESES 181

3.3.5.2.4 SUFFIXES 182

3.3.5.2.5 TITLES AND DEGREES 182

3.3.5.3 Status Field 182

3.3.5.4 Estate Names 183

3.3.5.5 Trust Names 183

3.3.6 Search Aids 183

3.3.6.1 Equivalencies 184

3.3.6.2 Auto Completion 184

3.3.6.3 Soundex 185

3.3.6.4 Political Divisions 186

3.3.6.5 Words Beginning with The, A, An 186

3.3.6.6 Results and Punctuation, Symbols, and Spaces 186

3.3.7 Corrections to Index 187

Chapter 3: Real Estate Instrument Registration and Indexing —Updated 12/2016 | 91

3.4 Uniform Commercial Code Filings 187

3.4.1 Registration 188

3.4.2 Indexing 190

3.4.3 Information Requests 190

3.5 Torrens Law 191

3.5.1 Background and Use 191

3.5.2 Title Registration 192

3.5.3 Deeds of Trust and Other Liens and Claims 193

3.5.4 Ownership Transfers 194

3.5.5 Indemnity 195

3.5.6 Release from Registration 196

92 | North Carolina Guidebook for Registers of Deeds

obligation.

153

If the secured creditor fails to provide a satisfaction as

required, an attorney licensed to practice law in North Carolina, acting as

“satisfaction agent,” may record an “adavit of satisfaction” after complet-

ing the steps required by statute.

154

e borrower’s attorney’s adavit of satisfaction must contain informa-

tion prescribed by statute about the security instrument and about having

completed the procedure for demanding a satisfaction instrument from

the secured creditor or about the procedure not being necessary under

the circumstances, and it must be signed by the borrower’s attorney as

satisfaction agent and acknowledged or sworn to or armed.

155

e regis-

ter is not responsible for reviewing the adavit to ensure that it contains

the required information. e statute provides that a register may not

refuse to accept an adavit of satisfaction “substantially complying” with

the requirements unless it “is submitted by a method or in a medium not

153. G.S. 45-36.9(a).

154. G.S. 45-36.15.

155. G.S. 45-36.13; G.S. 45-36.16.

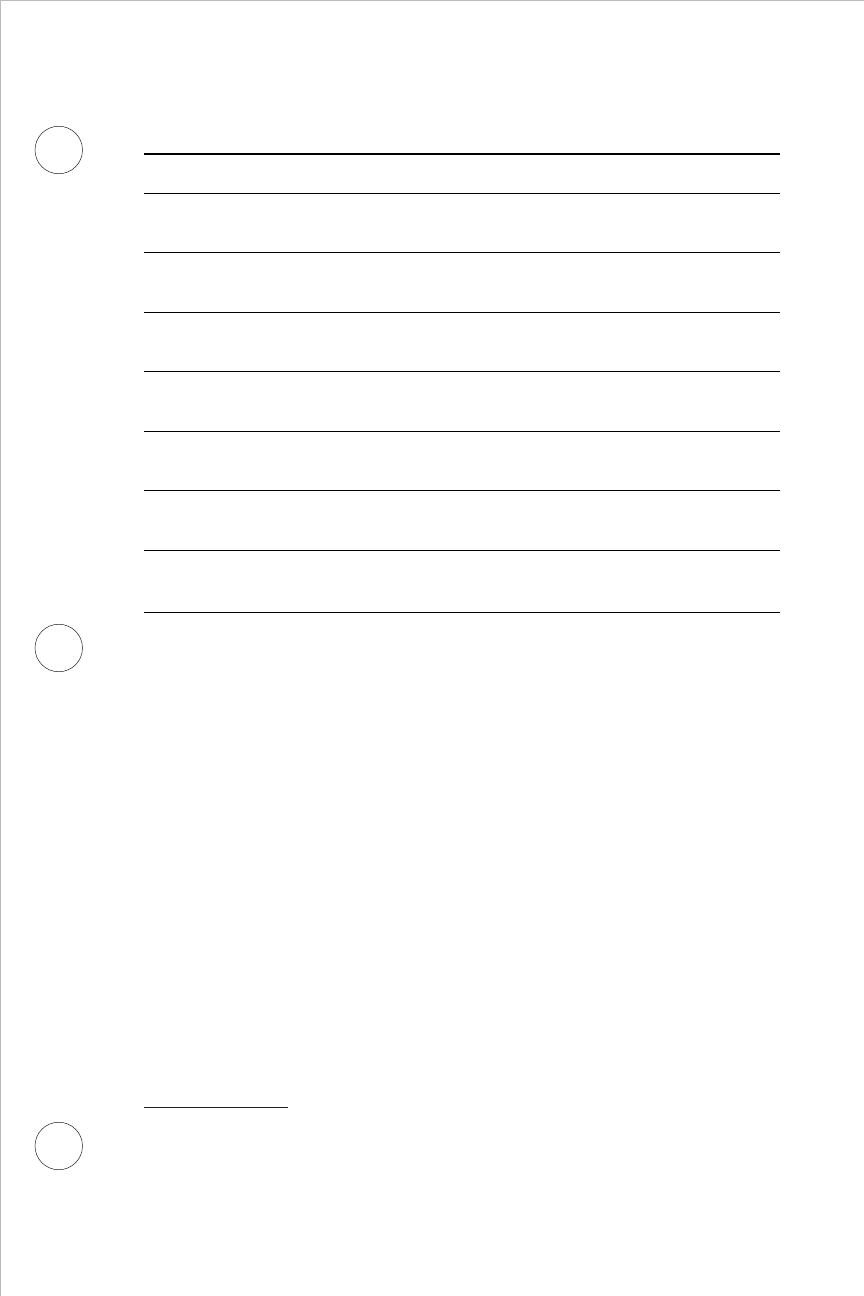

Table 3.2 Standard Satisfaction Forms

Type of Instrument Signatory

Satisfaction of security instrument (no fee)

(G. S. 45-36.11)

Secured creditor

Trustee’s satisfaction of deed of trust (no fee)

(G.S. 45-36.21)

Trustee (secured creditor may also sign

that obligation is extinguished)

Notice of satisfaction (no fee)

(G.S. 47-46.1)

Secured creditor or trustee

Certicate of satisfaction (no fee)

(G.S. 47-46.2)

Owner of note or secured creditor

Adavit of satisfaction (no fee)

(G.S. 45-36.17)

N.C. attorney satisfaction agent

Partial release (fee applies)

(G.S. 45-36.22)

Secured creditor or trustee

Deed of release (fee applies)

(G.S. 45-41)

Party holding interest

Chapter 3: Real Estate Instrument Registration and Indexing —Updated 12/2016 | 147

authorized for registration by the register of deeds under applicable law”

or it is not signed by the satisfaction agent and acknowledged as required

by law for a real estate conveyance.

156

e statute expressly states that a

register is not “required to verify or make inquiry concerning” “the truth of

the matters stated” in the adavit or “the authority of the person execut-

ing” it.

157

An instrument purporting to be an adavit of satisfaction that is

not apparently signed by the borrower’s attorney cannot be registered. e

register must verify that the instrument is signed by the satisfaction agent,

and only the borrower’s attorney can be a satisfaction agent.

3.2.7.5 Deeds of Release

A record that a security instrument has been terminated also may be

accomplished by recording a deed of release.

158

To be recorded, a deed

of release must be acknowledged in the same manner and is subject to

the same register verication and recording fee requirements as any other

deed.

As mentioned above, sometimes a lender wants to release a security

instrument from particular real estate even though the underlying obliga-

tion has not been paid in full. is occurs, for example, when a deed of

trust or mortgage applies to several lots and the lender is releasing only one

lot in connection with a partial payment of the obligation secured by the

deed of trust. A form of satisfaction called a partial release may be used.

159

Practitioners customarily use partial release deeds for this purpose.

160

156. G.S. 45-36.18(c).

157. G.S. 45-36.18(c)(2).

158. G.S. 45-41.

159. G.S. 45-36.22.

160. e statute providing for a deed of release authorizes the deed to “satisfy of

record, discharge and release [the deed of trust or mortgage] and all property thereby

conveyed.” G.S. 45-41. is raises a question about whether the prescribed deed of

release may be used for less than “all property,” as it often is in practice. e statutes

do not clearly provide that a satisfaction of security instrument or trustee’s satisfac-

tion may be used for partial release of secured real estate. e statute for subsequent

instruments refers to a “release or partial release of property from the lien of a secu-

rity instrument” in the denition of subsequent instruments. G.S. 161-14.1(a)(3)(j). It

separately refers to “a record of satisfaction or other instrument purporting to satisfy

a security instrument.” is suggests that “satisfy” can be interpreted “completely

satisfy,” whereas “release” is a term used in the context of both full and partial pay-

ments. is distinction between “satisfy” and “release” may reect a custom of using

148 | North Carolina Guidebook for Registers of Deeds

3.2.10 False Lien Claims

Registers are public ocials who take oaths to maintain the laws of North

Carolina. A register may justiably be concerned about placing on the pub-

lic record an instrument that is presented for the obvious sole purpose

of harassment, fraud, or commission of a crime, or an instrument that

appears to have no conceivable legitimate purpose for being in the public

real estate records. For example, some wrongdoers le a “nonconsensual

lien” against a targeted public ocial that claims a security interest unless

the target responds within a given time, but the ocial knows nothing

about the claim. Although the frivolous nature of these kinds of instru-

ments may be obvious, they still could cause delay or complication while

the circumstances are investigated and costs to the target if judicial relief

must be sought. Someone who les a fraudulent or frivolous instrument

may be prosecuted for a criminal act, such as common law fraud or the

statutory felony of ling a false lien or encumbrance.

200

Someone harmed

may have a civil remedy, such as for fraud as well as for slander of title.

201

A statute authorizes registers to reject instruments that seem to be

falsely claiming a lien against a public ocer, a public employee, or an

immediate family member of the ocer or employee on account of the

ocer or employee’s ocial duties, and the law requires certain actions if

this occurs or if a court declares a lien to be false.

202

e statute provides

that “if a register of deeds has a reasonable suspicion that the lien or

encumbrance is false..., the register of deeds may refuse to record the

lien or encumbrance” and that the register will not “be liable for recording

or the refusal to record a lien or encumbrance” according to this law.

203

Note

that this law is permissive and not mandatory—it does not impose a duty on

registers to review documents claiming liens or encumbrances and judge

whether they appear to be valid. is legislation is aimed at documents that

claim a lien against public ocials when the presenters obviously had no

nancial transaction involving the ocials. According to the Federal Bureau

of Investigation, such tactics may be indicated by “documents that contain

peculiar or out-of-place language,” including “references to the Bible, e

200. G.S. 14-118.6(a); G.S. 44A-12.1.

201. Allen v. Duvall, 63 N.C. App. 342, 345, 304 S.E.2d 789, 791 (1983), rev’d on

other grounds, 311 N.C. 245, 316 S.E.2d 267 (1984).

202. G.S. 14-118.6.

203. G.S. 14-118.6(b).

Chapter 3: Real Estate Instrument Registration and Indexing —Updated 12/2016 | 159

Constitution of the United States, U.S. Supreme Court decisions, or treaties

with foreign governments, personal names spelled in all capital letters or

interspersed with colons (e.g., JOHN SMITH or Smith: John), signatures

followed by the words ‘under duress,’ ‘Sovereign Living Soul’ (SLS), or a

copyright symbol (©), personal seals, stamps, or thumb prints in red ink,

and the words ‘accepted for value.’ ”

204

ere have been prosecutions and

convictions against those using lien claims as a tactic to intimidate and

harass ocials.

If a register refuses to record an instrument based on this law, the pre-

senter may record a “Notice of Denied Lien or Encumbrance Filing” on a

form that the N.C. Secretary of State has approved. A recording fee is not

necessary for this notice. Any interested person, including the presenter,

then has ten business days to le a court action to challenge the rejection.

If the court determines that the document was recordable, the order can

be led with the register. If the court nds that there is no basis for the

proposed ling, the court will order that the proposed ling is void and that

it will not be recorded, and a copy of the order is led with the register. If

a register receives a court order declaring that a led lien or encumbrance

is false, and therefore void, in addition to ling the order the register is

required to conspicuously mark on the rst page of the original record

previously led the following statement: “THE CLAIM ASSERTED IN

THIS DOCUMENT IS FALSE AND IS NOT PROVIDED FOR BY THE

GENERAL LAWS OF THIS STATE.”

205

3.3 Indexing Real Estate Instruments

Registers of deeds maintain indexes so that records can be found. e

principal method for accomplishing this goal is to index the names of the

parties to the instruments with a reference to the book and page at which

an image of the record can be seen. e following sections describe the real

estate instrument indexing requirements and procedures.

204. Federal Bureau of Investigation, Sovereign Citizens: A Growing Domestic reat

to Law Enforcement, www.fbi.gov/stats-services/publications/law-enforcement-bulletin/

september-2011/sovereign-citizens.

205. G.S. 14-118.6.

160 | North Carolina Guidebook for Registers of Deeds—Updated 12/2016

beneciary as named in the assignment is indexed as a grantee. A cross-

reference to recording data for the original security instrument is indexed

as it appears in the assignment.

3.3.4.5.3 ASSUMED NAME CERTIFICATE

Any person, partnership other than a limited partnership, or corporation

that does business in a county under an assumed name must le a cer-

ticate with the register.

239

e signature must be acknowledged.

240

is

requirement does not apply to professional service entities that le required

reports with licensing agencies.

241

e certicate is indexed in the consoli-

dated index with the person or entity ling the certicate, and the assumed

name, as grantors.

A person or rm records a certicate of transfer when the assumed name

is being transferred to another person and records a certicate of with-

drawal when it no longer intends to conduct business under the assumed

name.

242

e certicate of transfer or withdrawal must be executed by the

person or rm that executed the original certicate of assumed name, and

the execution must be acknowledged.

243

e assignor and the assumed

name are indexed as grantors and the assignee is indexed as a grantee.

Registers should keep apprised of developments that might require them

to forward copies of assumed business documents led in their oces to

the N.C. Secretary of State for entry into a centralized statewide database.

3.3.4.5.4 BANKRUPTCY NOTICE

Someone les a notice of bankruptcy to alert creditors about an owner

having led a federal bankruptcy petition. By federal law, no creditor may

foreclose on property owned by a debtor in bankruptcy without the court’s

permission, known as relief from the stay, and no litigation may be com-

menced or continued against the debtor without such relief. e name of

the debtor in the bankruptcy as shown on the notice is indexed as a grantor.

3.3.4.5.5 DEED

A deed is an instrument that conveys an interest in real estate. An instru-

ment that is a deed usually contains the word “deed” within its title, such

239. G.S. 66-68(a).

240. G.S. 66-68(b).

241. G.S. 66-68(e).

242. G.S. 66-68(f).

243. Id.

Chapter 3: Real Estate Instrument Registration and Indexing —Updated 12/2016 | 175

as “warranty deed,” “quitclaim deed,” or “easement deed.” Although a deed

of trust is a form of deed, it has its own indexing considerations, which are

described in Section 3.3.4.5.6 below. Customarily, only sellers or persons

conveying property sign a deed, and they are indexed as grantors. e

buyers or persons receiving a property interest are indexed as grantees.

Occasionally, something more than a simple conveyance is happening with

a deed, usually indicated by signatures for both parties. is may occur, for

example, if two owners are signing one deed to exchange a portion of land

along a boundary. When it appears that someone is releasing or conveying

something back to a grantor in exchange, both parties should be cross-

indexed in grantor and grantee capacities.

3.3.4.5.6 DEED OF TRUST

A deed of trust is a security instrument by which owners convey an inter-

est in property to a trustee for a lender’s benet. e owners are indexed

as grantors, and the lenders, also known as beneciaries, are indexed as

grantees. Customarily, only the owners sign the deed of trust, although

sometimes a lender also signs. e trustee usually is an attorney or insti-

tution. ose who search indexes look for deeds of trust in the name of

the owner and beneciary, and by statute the name of the trustee is not a

required entry.

244

3.3.4.5.7 FORECLOSURE DEED

After a foreclosure, the trustee or mortgagee will record an instrument

that will be in the form of a foreclosure deed or notice of conveyance.

With it the trustee or lender is transferring the property to the buyer at

foreclosure. e trustee or mortgagee who transfers is indexed as a grantor,

and the purchaser at foreclosure is indexed as a grantee. e name of the

owner whose property is being conveyed also is indexed as a grantor.

245

e

original beneciary also will be indexed as a grantee if and as identied in

the notice of foreclosure.

3.3.4.5.8 PLATS

e Minimum Standards require plats to be indexed in the consolidated

real property indexes.

246

Each plat is to be indexed in the grantor index in

244. G.S. 161-22(d).

245. G.S. 161-22.1.

246. Minimum Standards Rule 6.01.

176 | North Carolina Guidebook for Registers of Deeds—Updated 12/2016

the name of the property owner and in the name of the plat title, as shown

in the property designation portion of the plat.

247

Right-of-way plans recorded by the N.C. Department of Transportation

must be cross-indexed “by number of road aected, if any, and by identi-

cation number.”

248

Transportation corridor maps must be “cross-indexed by number of

road, street name, or other appropriate description.”

249

e government

agencies or units adopting such maps should be indexed as grantors, and

the proposed road numbers, street names, or rail lines should be indexed

as grantees; this apparently will meet the statutory requirements for cross-

indexing. ese maps are not recorded in the regular map books or les

and should be indexed in the general real property indexes. e presenter

must provide a list of the names of all property owners aected by the cor-

ridor, and the register indexes each name as a grantor.

250

Condominium plats are indexed in the deed indexes, with the property

owner and condominium as grantors. e index entry should also refer to

the book and page and date of recording of the declaration of condominium

as shown on the plan.

251

3.3.4.5.9 POWER OF ATTORNEY

With a power of attorney, someone identied as a principal gives an attorney-

in-fact the power to sign an instrument or perform other acts in the princi-

pal’s name. e principal giving the power is indexed as a grantor and the

designated attorney-in-fact is indexed as a grantee. When the power of attor-

ney instrument gives more than one person a power, such as when alternate

attorneys-in-fact are named, those recipients also are indexed as grantees.

Identifying the parties to a power of attorney instrument can be prob

-

lematic when the instrument involves securitized trusts. Lenders some-

times use indecipherable references that do not appear to be actual names

and whose relationship to the recorded instrument is unclear. For example,

the instrument may refer to an appointment being made to an institu-

tion in connection with “Securitized Trust ABC, Mortgage Pass-rough

Certicates, Series 20015-05.” is is not a name of a lender from whom

247. Id. Rules 6.02, 6.03.

248. G.S. 136-19.4(c).

249. G.S. 136-44.50(b)(3).

250. G.S. 136-44.50(a)(3) and (b)(4).

251. G.S. 47C-2-109(a); Minimum Standards Rule 6.04.

Chapter 3: Real Estate Instrument Registration and Indexing —Updated 12/2016 | 177

the borrower got the mortgage loan or of anyone else who appears to be in

the chain of title for the premises. Some instruments contain long lists of

securitized trusts for which the attorney-in-fact is authorized to execute

instruments, without respect to whether these trusts in fact hold any mort-

gages in the jurisdiction. Financial institutions may be including every pos-

sible loan arrangement into a single instrument and recording it in every

jurisdiction in which it does business, without considering registry index-

ing or title searches. Even though no one will ever look for such names in

the index, and the relevant instruments can reasonably be found with the

actual parties involved, if a name appears to be granting a power or receiv-

ing it the register may deem it to be for a party to the instrument being

recorded and therefore appropriately indexed. But this may be unclear and

the register cannot reasonably be faulted for not indexing the names in cir-

cumstances involving such confusing drafting. For example, the following

language in a power of attorney instrument would not require indexing of

the names on a schedule:

ABC Bank (“the Bank”) appoints Acme Servicing LLC (“the

Servicer”) to be the Bank’s attorney-in-fact in connection with

the Pooling and Servicing Agreements in Schedule A hereto . . .

at the bank is giving powers to the servicer as well as information in the

schedule about underlying agreements or loans does not make the names

listed in the schedule parties to the power of attorney instrument. On the

other hand, a register would index the names on the schedule when lan-

guage similar to the following is used:

e trusts identied in the attached Schedule A (“the Trusts”),

by and through ABC Bank as Trustee (“the Trustee”), appoint

Acme Servicing LLC (“the Servicer”) to be their attorney-in-fact

in connection with . . .

In this example the trusts are named as principals appointing a servicer for

them, so they all appear to be parties to the attorney-in-fact instrument.

When an instrument ambiguously identies the relationship of names the

presenter should not be surprised by varied interpretations of the indexing

requirements and excessive name recording fees.

3.3.4.5.10 REQUEST FOR NOTICE OF FORECLOSURE

A lender who makes a loan secured by a deed of trust that is subordinate to

a prior recorded deed of trust or mortgage, as well as any other person, may

177a | North Carolina Guidebook for Registers of Deeds

le an instrument requesting notice if the beneciary of the prior-recorded

deed of trust or mortgage exercises the power of foreclosure sale. By statute,

the register is to index as grantors the owner who gave the prior recorded

deed of trust or mortgage and the person requesting the notice. e register

also must include a reference to the recording information for the prior

Chapter 3: Real Estate Instrument Registration and Indexing | 177b

recorded security instrument to which the request refers.

252

e original

beneciary as named in the request also should be indexed as a grantee.

3.3.4.5.11 SATISFACTION OF SECURITY INSTRUMENT

In any form and by any title, satisfaction instruments—commonly in the

form of a satisfaction of security instrument, trustee’s satisfaction, notice

of satisfaction, certication of satisfaction, or deed of release—are records

showing that the security instruments, including, but not limited to, deeds

of trust, are no longer in eect. Beneciaries or trustees who give the satis-

faction instruments are indexed as grantors. Searchers want to be able to

nd a satisfaction instrument when they see on the record the deed of trust

or other security instrument to which it applies, and this will occur when

the satisfaction instrument is properly indexed as a subsequent instrument.

Accordingly, owners who were grantors of security instruments as named

in the satisfactions are indexed as grantors, and original beneciaries are

indexed as grantees if and as they are named in satisfaction instruments.

A cross-reference to recording data for the original security instrument is

provided if and as it appears in the satisfaction instrument.

3.3.4.5.12 SUBSTITUTION OF TRUSTEE

With a substitution of trustee instrument the beneciary of a deed of trust

is removing someone previously named as a trustee and appointing some-

one else to that capacity. e beneciary making the substitution is indexed

as a grantor, and the new trustee is indexed as a grantee. A substitution

is a subsequent instrument to the instrument that previously named a

trustee. Accordingly, owners who were grantors of security instruments

as named in the substitution are indexed as grantors and reference is made

to the security instrument recording data as provided in the substitution.

Although the original trustee may not be a required index entry, registers

commonly do index them as grantees.

3.3.5 Format of Index Name Entries

e basic approach for indexing the names of parties to an instrument is to

enter them in all capitals exactly as they appear on the document—that is,

as they were expressed by the drafter. In most cases this is simply a matter

of entering all characters in the same sequence.

252. G.S. 45-21.17A(b).

178 | North Carolina Guidebook for Registers of Deeds

197— Updated 12/2016

Chapter 4

Marriage Licenses

4.1 Registers’ Role (Updated 12/2016) 199

4.2 Capacity to Marry (Updated 12/2016) 201

4.2.1 Marital Status 201

4.2.2 Age Requirements 202

4.2.3 Kinship 203

4.2.4 Gender (Updated 12/2016) 204

4.2.5 Competency 204

4.3 Issuance of Marriage Licenses 204

4.3.1 Marriage License 205

4.3.2 Application Form and Identity (Updated 12/2016) 205

4.3.3 Personal Appearance 206

4.3.4 Age 207

4.3.5 Social Security Numbers 207

4.3.6 Fees 208

4.3.7 Responsibility of the Register 208

4.4 Marriage Ceremony and Record 209

4.4.1 Marriage Ceremony (Updated 12/2016) 209

4.4.2 Marriage Records 211

4.5 Delayed Marriage Certicates 213

4.6 Changes in Applications and Licenses 214

199

Chapter 4

Marriage Licenses

4.1 Registers’ Role

Registers of deeds issue marriage licenses to couples who can show that

they meet minimum age and other North Carolina law requirements. e