072023COMP-896

Deposit Account Agreement and Funds Availability Policy

Effective August 12, 2023

Laurel Road is a brand of KeyBank N.A. All products are offered by KeyBank N.A. Member FDIC. ©2023 KeyCorp® All

Rights Reserved.

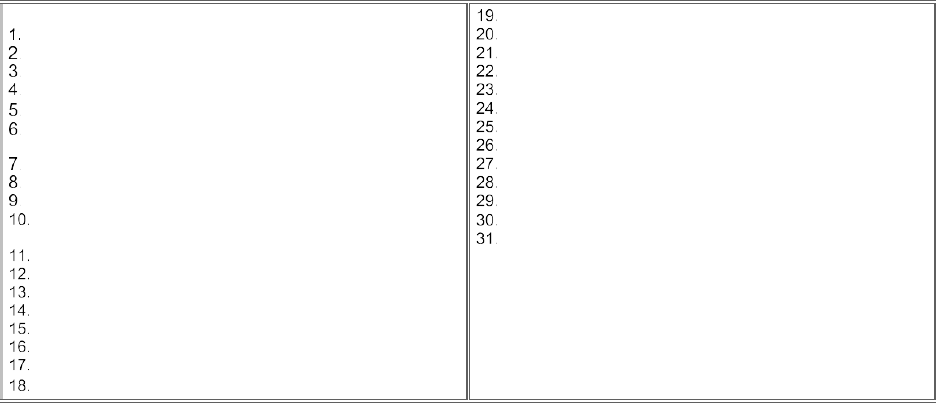

TABLE OF CONTENTS

PART I - DEPOSIT ACCOUNT AGREEMENT

This Agreement

Opening Your Account

Deposits to Accounts

Collection of Items Deposited

Withdrawals

Posting Order; Payment of Items; Overdrafts; Substitute

Checks

Stopping Payment

Account Disclosure and Fees

Signature Card and Resolutions; No Two Signer Accounts

Our Right of Set-off

Adverse Claims; Interpleader; Legal Process

Assignment; Pledge

Waiver of Notices

Check Cashing

Addresses; Notices

Arbitration Provision

Applicable Law

Amendments; Non-Waiver; Severability

Credit Reports

Disclosure of Account Information

Account Statements: Limitation on Time to Report

Unauthorized Transactions, Forgeries and Errors

Time Account Certificates

Joint Personal Accounts; Survivorship Accounts

Payable on Death Accounts

Fiduciary and Custody Accounts

Powers of Attorney

Closing Accounts

Inactive Accounts/Unclaimed Funds

Electronic Authentication of Signature; Electronic Records

Enforceability of Electronic Records and Signed Documents

PART II - FUNDS AVAILABILITY POLICY

Death/Incompetence

PART I - DEPOSIT ACCOUNT

AGREEMENT

Laurel Road is a brand of KeyBank National Association Member FDIC. This Agreement governs all Accounts you maintain with us

under the Laurel Road brand. As used in this Agreement, "we," "us," "our," and similar terms mean KeyBank National Association,

Cleveland, Ohio, its respective parents, wholly or majority owned subsidiaries, affiliates, predecessors, successors, assigns,

employees, officers and directors. "You," "your," and similar terms mean each person listed on our records as the owner of the

Account and any person you authorize to sign or act on your behalf.

1.

This Agreement. This Agreement is the contract between you and us that governs all Personal and Business Accounts. You

agree to its terms by opening an Account. You should read this Agreement carefully and keep a copy for your records. From time

to time, we may offer new types of Accounts and may cease offering some types of Accounts. This Agreement governs all of these

new types of Accounts and continues to govern any Accounts you may have that we no longer offer. As used in this Agreement:

•

Account means all Checking, Savings and Time Deposit Accounts. "Personal Accounts" means Accounts we classify

from time to time as personal and offer primarily to consumers for personal, family or household purposes. "Business

Accounts" means all other Accounts and includes Accounts we offer from time to time primarily to businesses,

organizations, public entities, commercial and non-profit enterprises, corporations, partnerships, limited liability

companies, sole proprietors and associations.

•

Checking Accounts means all Accounts we designate from time to time as Checking Accounts.

•

Savings Accounts means all Accounts we designate from time to time as Savings Accounts.

•

Time Accounts means all Accounts that you deposit with us for a specified period of time, and we classify from time to time

as time deposits.

Additional t

erms apply to Time Accounts, retirement Accounts and to some other types of Accounts. You receive a copy of these

other terms when you open your Account, and you agree to comply with them. Some Accounts, such as retirement Accounts and

uniform gifts or transfers to minors custodial Accounts, are also subject to the terms and conditions imposed by specific laws

governing such types of Accounts.

Interest bearing Checking Accounts may be opened and maintained by any individual or business entity.

2.

Opening Your Account. To open and maintain your Account you must complete the proper forms and provide us with any

other documents, information, or items that we may require to establish and maintain an Account with us. These requirements

include acceptable forms of identification including but not limited to a thumbprint in certain states, any required minimum deposit,

and your Taxpayer Identification Number. If these items are not provided within a reasonable period of time, we may close your

Account as described in Section 16. If you open a non-personal Account with us, you must certify the adoption of resolutions

acceptable to us that authorize us to transact business with your designated representative(s).

If you open a fiduciary Account, other documents required depend on the type of Account being opened. For example, if you

open an estate Account you need certified court appointment papers naming you as executor or administrator of the estate. If you

are a trustee under a written trust agreement, you must show us a copy of the trust agreement specifying the beneficiary, the

trustee, the trust property, and verifying the trustee's authority to open the Account. Federal tax laws require us to obtain from

each Account

072023COMP-896

owner a certification of the owner's Taxpayer Identification Number and whether the owner is subject to backup withholding. You

must notify us if your Taxpayer Identification Number is incorrect or if you become subject to backup withholding. We must withhold

some of the interest payable on your Account if you fail to give us a correct Taxpayer Identification Number or otherwise become

subject to backup withholding. It is our policy not to open an Account unless you certify your Taxpayer Identification Number or have

applied for a Taxpayer Identification Number. If you fail to provide an appropriate Taxpayer Identification Number, we may close

your Account.

Standard Overdraft Services that may come with your Account. You may make your selection as described below at the time

you open your Account or any time thereafter.

THE FOLLOWING APPLIES TO CONSUMER ACCOUNTS ONLY

In our discretion, we may decide to pay/process a check, recurring debit card transaction, preauthorized automatic debit, telephone-

initiated transfer, electronic transfer, or other item as a service to you even if the available balance in the Account on which it was

drawn/debited is not sufficient to cover the transaction. When we do so the payment may create an "overdraft" in your Account.

Overdrafts can also result from other circumstances, such as when a check deposited by you is returned to us unpaid. If you do not

want us to pay/process any of these items as a service to you when the available balance in the Account on which it was

drawn/debited is not sufficient to cover the transaction, please contact Laurel Road customer service at 1-833-427-2265. For clients

using a TDD/TTY device please call 1-800-539-8336.

We do not authorize and pay an overdraft for Automated Teller Machine ("ATM") and everyday debit card transactions unless you

ask us to. Please review the Overdraft Services Consent Form provided. If you want us to authorize and pay overdrafts on ATM and

everyday debit card transactions, at our discretion, you may call 1-833-427-2265 (if using a TDD/TTY device, please call 1-800-539-

8336) or sign on to Online Banking and select the Overdraft Services Options link on the Self-Service tab. Normal overdraft fees will

likely apply. If you do not contact us to make an overdraft services selection, we will consider this to mean you do not want us to

authorize and pay overdrafts on ATM and everyday debit card transactions. On a joint Account, any account owner can make an

overdraft services selection that will apply to these transactions.

You agr

ee to pay us the full amount of any overdraft on your Account immediately upon demand, together with any additional fee we

charge.

On joint Accounts, each of you is jointly and severally liable for overdrafts. This means we can collect the full amount of the

overdraft, plus any fees, from either of you, even if you did not create the overdraft, or collect from all of you.

THE FOLLOWING APPLIES TO BUSINESS ACCOUNTS ONLY

In our discretion, we may decide to pay/process a check, ATM withdrawal, debit card transaction, preauthorized automatic debit,

telephone-initiated transfer, electronic transfer or other item as a service to you even if the available balance in the Account on

which it was drawn/debited is not sufficient to cover the transaction. When we do so the payment may create an "overdraft" in your

Account. Overdrafts can also result from other circumstances, such as when a check deposited by you is returned to us unpaid. You

agree to pay us the full amount of any overdraft on your Account immediately upon demand, together with any additional fee we

may charge. If you do not want us to pay/process any of these items as a service to you when the available balance in the Account

on which it was drawn/debited is not sufficient to cover the transaction, please contact Laurel Road customer service at 1-833-427-

2265. For clients using a TDD/TTY device please call 1-800-539-8336.

Wireless Express Consent (applies to Consumer Accounts only)

By providing a telephone number for a cellular telephone, other wireless device, or a landline number that was later converted to a

wireless device, you are expressly consenting to receiving communications at that number, including, but not limited to, prerecorded

or artificial voice message calls, text messages, and calls made by an automatic telephone dialing system from KeyBank National

Association and its affiliates and agents. This express consent applies to each such telephone number that you provide to us now or

in the future and permits such calls regardless of their purpose. These calls and messages may incur access fees from your cellular

provider.

3.

Deposits to Accounts. All deposits you make are subject to "proof" by us. This means we reserve the right to review the cash,

checks or other items deposited to confirm the amount of the deposit and that all checks and other items are properly payable. We

can correct any errors we find. For example, if you made an error in adding up the amount of your deposit, we can correct your

Account records to reflect the actual amount deposited. We can correct errors even if we gave you a receipt for the incorrect amount

or already posted the incorrect amount to your Account. We can supply your endorsement if it is missing from any check or other

item you deposit. If a check or other item was not properly payable, we can decline to credit your Account for the amount of the

check or other item.

We reserve the right to refuse to accept any check or other item to be deposited. In particular, we will not accept deposits of any

checks or other instruments that cannot be mechanically processed by our check/item processing hardware and software, or

otherwise be processed and paid in accordance with our standard practices or with standard check/item collection practices of

banks in general (e.g. checks in the amount of $100 million or greater).

When we credit your Account for a check or other non-cash item you deposit, the credit is conditional. This means we can revoke

the credit if the check or other item is dishonored or not paid for any reason, even if we are unable to return, or there is any delay in

returning, the unpaid check or other item to you. We can also revoke a credit for any other reason if permitted under applicable law.

You agree to waive the requirements of any law limiting the time within which we must revoke a credit or requiring us to notify you of

nonpayment, dishonor or the revocation of a credit.

Items sent to us in the mail for deposit are not considered to have been received by us until delivered to us by the U.S. Post

al

Service. Items placed in one of our night depository boxes or similar boxes at our facilities are not considered received until we

remove them (which usually occurs by 9:00 a.m. on business days). Items delivered to us electronically are not considered to have

been received by us until accepted by us. Until we receive them, you bear the risk that deposits will be lost, stolen or destroyed.

072023COMP-896

We make the funds you deposit available for withdrawal in accordance with our Funds Availability Policy, which accompanies this

Agreement. Until the funds become available, you cannot withdraw them or write checks against them, and we can refuse to permit

withdrawals or pay checks if the funds to do so are not yet available.

You may not deposit remotely created checks (items not bearing the maker's signature but purporting to be authorized by the

maker) to an account with us without our prior, express written consent. This provision does not apply to checks created on your

behalf by the paying bank. If you deposit remotely created checks with us, you agree that we may withhold a portion of the proceeds

of such drafts or other funds in your Accounts in a reserve account, in an amount that we reasonably believe may be needed to

cover future chargebacks, returned items, and/or claims that such drafts were unauthorized. You grant us a security interest in the

reserve account. Unless we agree otherwise in writing with you, reserve funds shall not bear interest. Our rights to charge your

Account for returned remotely created checks will not be limited by the balance or existence of any reserve. Our rights with respect

to the reserve, as well as the security interest granted to us, shall survive the termination of this Agreement. We may discontinue

accepting remotely created checks at any time without cause or prior notice.

Restriction on Deposit of Substitute Checks. You are prohibited from depositing or cashing any substitute check with us that was

not previously created by a financial institution and then transferred to you, unless you have signed a separate service agreement

with us that governs this process. Please contact your Account Officer to discuss these services for business customers in greater

detail. In the event you deposit a substitute check without our prior authorization and we subsequently process the substitute check,

you assume all risk of losses, damages, liabilities and other obligations that may arise as a result of your action, and you agree to

indemnify and save us harmless in the manner described in the section titled Adverse Claims; Interpleader; Legal Process from

all losses, damages, liabilities, obligations, expenses and costs that we incur as a result of your action. Substitute checks created by

us or another financial institution that are returned to a customer unpaid (i.e. a substitute check of a deposited item returned unpaid)

may be redeposited in accordance with applicable rules, regulations and laws.

IMPORTANT NOTICE TO BUSINESS CUSTOMERS REGARDING INTERNET GAMBLING.

The Unlawful Internet Gambling Enforcement Act (UIGEA) prohibits any person or other entity from making or accepting a

Restricted Transaction as defined in UIGEA and Regulation GG. All Restricted Transactions at KeyBank are prohibited. We have

established certain policies and procedures designed to identify and block, or prevent payment of, any Restricted Transaction

involving your Account(s) with us. Also, we may at our sole discretion block or prevent payment of all Internet gambling transactions

without notice to you. You hereby acknowledge and agree that we shall have no obligation or liability of any kind for blocking, or

failing to block, any Restricted Transaction or other Internet gambling transaction.

4.

Collection of Items Deposited. When you deposit or ask us to pay a check or other item that is not drawn on us, we act as your

collecting agent to obtain payment for you. We may forward these items directly or indirectly to any other bank, including the bank

on which the item is drawn. Items and their proceeds may be handled by any Federal Reserve Bank in accordance with applicable

Federal Reserve rules, by clearinghouses in accordance with their rules, and by other banks in accordance with common bank

practices. You agree that all rules, regulations and practices of Federal Reserve Banks and clearinghouses also apply to the

payment and collection of the checks and items you give us. When we act as your collecting agent, we assume no duties or

responsibilities (other than to use ordinary care), and we are not responsible for the actions of any Federal Reserve Bank or other

bank or clearinghouse that handles the check or item during the collection process. You agree to reimburse us for any loss we may

sustain (or damages we must pay another person for their loss) resulting from the condition of any check or item you deposit. This

includes illegible and missing signatures, numbers or other information, instructions, and disclaimers on the front or back of the

check or item, and use of the space on the back of checks reserved for endorsement by banks that handle the check for collection.

5.

Withdrawals. Federal law requires us to impose special rules limiting withdrawals from some Accounts. The rules differ

depending on the type of Account.

•

Checking Accounts. In accordance with federal law, we reserve the right to require seven days' prior notice of any transfer

from a Money Market Checking Account (Negotiable Order of Withdrawal). Subject to these limitations, you can make an

unlimited number of withdrawals in person or by check and arrange for preauthorized transfers and withdrawals, including

telephone transfers.

•

Savings Accounts. Savings Accounts have no check-writing privileges unless we specifically tell you that you may write

checks on your Account. On Savings Accounts, you may arrange for preauthorized transfers and withdrawals and, if your

Savings Account has check-writing privileges, write checks, subject to the following limitation: during any monthly statement

period, you are permitted or authorized to make no more than seven transfers and withdrawals to another KeyBank account of

yours (including a transaction account) or to a third party by means of a preauthorized or automatic transfer, or telephonic

072023COMP-896

(Including data transmission) agreement, order or instruction, or by check, draft, debit card or similar order payable to third

parties, including transfers to third parties made through an automated teller machine or telephone and point of sale

transactions posted to your Account. You can make an unlimited number of withdrawals in person at an ATM. You can also

make an unlimited number of transfers through an ATM from one Checking or Savings Account to another Checking or

Savings Account. We reserve the right to require seven (7) days prior written notice of any intended withdrawal (whether made

in person, by check, by telephone or by preauthorized transfer or withdrawal).

•

Time Accounts. When you open a Time Account, you are agreeing to keep your funds on deposit with us in that Account until

the maturity date. We are not required to allow you to withdraw any or all of the funds in the Account until the maturity date. If

we do allow a withdrawal, we may require you to withdraw the full balance in the Account and pay an early withdrawal penalty.

Unless the disclosures given when you open a Time Account provide otherwise, you cannot change the terms of this Account,

make additional deposits or partial withdrawals either during the term or during any grace period after maturity.

•

Retirement Accounts. Most of the restrictions on withdrawals described above will apply to Accounts that are retirement

Accounts. Certain other restrictions will also apply. Refer to the documents governing your retirement Accounts for a complete

description of these restrictions.

For Accounts on which we have reserved the right to require prior notice of withdrawal, if we exercise that right, we can refuse to

allow any withdrawal for which proper notice was not given. This means, for example, that we can refuse to pay checks written

against the Account. If we take these actions, we are not liable to you for wrongful dishonor, for failure to release your funds or for

any other reason.

For Savings Accounts, if you exceed any of the limits on transactions, withdrawals, or checks, we may close your Account or

convert your Savings Account to a Checking Account. If we convert your Account, you agree to pay all fees we charge on Checking

Accounts and comply with all other terms and restrictions applicable to Checking Accounts.

You authorize us to transfer money from one Checking Account or Savings Account to another Checking Account or Savings

Account, or to a third party, when we receive instructions to do so from you over the telephone. You agree that we may record any

of your telephone calls to us when making a telephone transfer.

If we ask, you must provide us with identification or other documents or information acceptable to us in order to withdraw funds from

your Account. If we ask, you also must sign a document acknowledging that you received the funds withdrawn.

You must use only the forms made available through us, or other forms approved by us, when making deposits to, withdrawals from,

or writing checks on, your Account. All forms of checks must be standard size, bear your name and address, our name and address,

and the appropriate routing/transit and Account numbers, and be capable of being processed by our MICR check/item processing

hardware and software.

6.

Posting Order; Payment of Items; Overdrafts; Substitute Checks. We may change the posting order at any time with notice

to you. We establish different processing groups that are based on the date and/or time a transaction was initiated such as

transactions made by you after normal business hours or items initiated by us. For example, consumer or small business account

transactions that you make on a Saturday or Sunday are posted prior to a transaction you make during normal business hours on

the next business day.

The processing groups established depend on your Account type. For all consumer account types, cutoff times were established to

classify transactions as either prior day or current day. This results in two processing groups: (1) the prior day transactions

processing group and (2) the current day transactions processing group. Transactions that are classified as prior day include but are

not limited to the following:

•

ATM, debit card PIN/POS, telephone, and online banking transactions conducted between 7:00 p.m. and midnight eastern

time on the previous day; including transactions conducted between 7:00 p.m. Friday through midnight Sunday eastern time.

•

Debit card signature transactions with an authorization date (when available, otherwise we will use the settlement date) that is

prior to the current processing date are considered prior day transactions.

•

Person-to-person transactions through the Zelle© network (“Zelle© Transactions”) conducted between 7:00 p.m. and midnight

eastern time on the previous day; including Zelle© Transactions conducted between 7:00 p.m. Friday through midnight

Sunday eastern time.

•

Mobile Banking deposits made on a previous day to a consumer Account between 11:00 pm and midnight eastern time to a

consumer Account; including Mobile Banking deposits conducted between these time periods on Friday through midnight

Sunday eastern time.

All transactions not classified as prior day are considered current day transactions. Prior day transactions will post using the current

business day's processing date.

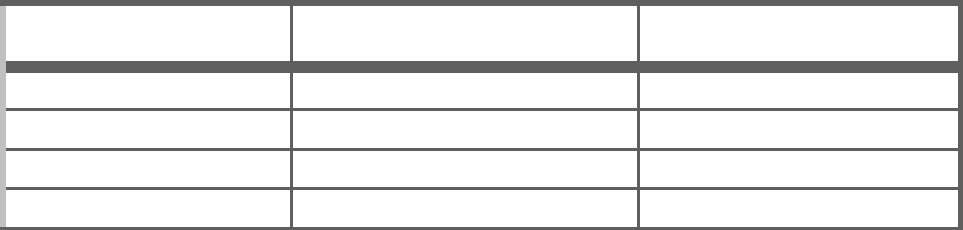

The following chart reflects the current posting order for categories within the processing groups for all consumer Account

transaction types. Certain limited exceptions may apply.

Primary Posting Categories

Examples of Transactions included in

Posting Categories

Sort Order

Pending Credits Reversed signed debit card purchase Low to high dollar amount

Credits ATM deposit, branch deposit Low to high dollar amount

Wire Transfers

Low to high dollar amount

Branch Withdrawals

Low to high dollar amount

072023COMP-896

ATM & Debit Card transactions

(pending & settled) *

ATM withdrawal, pending signed debit card

purchase, posted signed debit card purchase

Authorization date/time; if no authorization

date/time, then by settlement date/time; if

no settlement date/time, then low to high

dollar amount

Checks

Check number; if no check number, then

low to high dollar amount

All Other Debits ACH debit, E-Check, online banking bill pay Low to high dollar amount

OD Protection Transfer

Automatic advance from Cash Reserve Credit

(credit), Automatic Pymt. to Cash Reserve

Credit (debit)

As applicable

Service charges^

Overdraft Item Charge, Maintenance Service

Charge

As applicable

*Pending transactions will impact available balance but will not hard post to the account until settled.

^Does not include the Excessive Withdrawal Fee which will post with the associated withdrawal. Refer to the Deposit Account Fees

and Disclosures for details.

For all other business account type transactions, we will post items from highest dollar amount to lowest dollar amount within certain

categories. The following is the current posting order for all other business account type transactions. Certain limited exceptions

may apply.

We post all transactions as current day transactions in the following order:

Pending Credits, Pending Debits, Credits, Wire Transfers, other types of transfers, Debits All Other

Withdrawals by check are permitted only on Checking Accounts and on Savings Accounts with check-writing privileges. You agree

that, when a check or other item drawn on or payable from your Account is presented for payment, we can disregard any legends on

the check (such as "void after 60 days", "paid in full" or "void over $100"), any restrictive endorsements or other information,

instructions and disclaimers that would limit or tend to limit the negotiability of the check or other item. In our discretion, we may

process or decline to process any check more than six months old. We can also pay photocopies of checks accompanied by a

representation that the original was lost or destroyed. You also agree that we can pay checks before the date set forth on the check

(i.e. "post dated checks"). We have this right even if you give us notice that you wrote a postdated check. In order to prevent a post

dated check from being paid, you must give us a valid stop payment order.

We may debit your Account on the day an item is presented by electronic or other means, or at an earlier time based on

notification received by us that an item drawn on your Account has been deposited for collection in another financial institution.

We pay checks or other items from the funds that we determine, in our discretion, are "available" for withdrawal or use from your

Account. You should be aware of how transactions impact the funds available in your account. Generally, ATM and Debit Card

transactions have a two-step process: authorization and settlement. Transactions made with your ATM Card or Debit Card may

result in authorization holds. If we authorize an ATM Card or Debit Card transaction, the authorized amount will no longer be

available for withdrawal or use from your Account.

The following does not apply to commercial accounts: If an ATM Card or Debit Card transaction is authorized by us when there are

available funds in your account, but there are no longer funds to cover the full transaction amount (which may be different than the

amount authorized) at the time the transaction is settled, you will not be charged an Overdraft Item (“OD”) Charge on that

transaction. However, if the available balance in your Account is not sufficient to cover other transactions presented against your

Account such as checks or ACHs, you may incur OD Charges on those transactions. If Key does not receive the settlement

portion of the transaction within a few days (typically within 3-5 days of the authorization), the amount of the authorization may be

available again in your account’s available balance. Be aware that Key may still receive the settlement portion of the transaction

thereafter and will pay it. Your balance will then be reduced by the amount of the transaction. However, you will not be charged an

OD Charge for that settlement transaction if you had available funds at the time the transaction was authorized. Use caution when

utilizing a Debit Card for certain transactions like renting rental cars because the amount of the authorization may stay on your

account for approximately 14 days. See your Health Savings Account Card Disclosures for more information about authorizations

on an HSA Card. In some instances, a Debit Card or ATM Card transaction may not have an authorization. You will not be

charged an OD Charge on those transactions if the transaction exceeds your available balance. We don’t always know about all

transactions that may be presented for any given business day until we finish processing. You are in the best position to know all

of the transactions that may affect your Account balance.

In addition, funds you deposit may not be immediately available under our Funds Availability Policy. Likewise, we may have placed

a "hold" on some or all of the funds in your Account because, for example, we reasonably believe a court order has restrained us

from releasing funds to you. We will not be liable to you for damages, wrongful dishonor, or additional fees incurred if we dishonor or

decline to pay a check or other item drawn on or payable from your Account if the Account has insufficient available funds to pay the

check or other item. We do not have to check the balance in your Account more than once to determine if there are available funds.

072023COMP-896

If an item is presented for payment against your Account and is returned for any reason more than twice, we reserve the right to

cease any further negotiation of the item.

If you make a check or other item payable to the order of more than a single payee, and the check or item is presented to us for

payment without the endorsement of one or more payees, you authorize us to pay the item and charge your Account. In such event,

we will assist you, to the extent we deem practicable, in obtaining any such missing endorsement(s), or any reimbursement to which

you may be entitled.

What is a substitute check?

To make check processing faster, federal law permits banks to replace original checks with "substitute checks." These checks are

similar in size to original checks with a slightly reduced image of the front and back of the original check. The front of a substitute

check states: "This is a legal copy of your check. You can use it the same way you would use the original check." You may use a

substitute check as proof of payment just like the original check.

Some or all of the checks that you receive back from us may be substitute checks. This notice describes rights you, as a consumer,

have when you receive substitute checks from us. The rights in this notice do not apply to original checks or to electronic debits to

your Account. However, you have rights under other law with respect to those transactions.

THE FOLLOWING APPLIES TO CONSUMER ACCOUNTS ONLY

What are your rights as a consumer regarding substitute checks?

In certain cases, federal law provides a special procedure that allows you to request a refund for losses you suffer if a substitute

check is posted to your Account (for example, if you think that we withdrew the wrong amount from your Account or that we

withdrew money from your Account more than once for the same check). The losses you may attempt to recover under this

procedure may include the amount that was withdrawn from your Account and fees that were charged as a result of the withdrawal

(for example, bounced check fees).

The amount of your refund under this procedure is limited to the amount of your loss or the amount of the substitute check,

whichever is less. You also are entitled to interest on the amount of your refund if your Account is an interest-bearing Account. If

your loss exceeds the amount of the substitute check, you may be able to recover additional amounts under other law.

If you use this procedure, you may receive up to $2,500 of your refund (plus interest if your Account earns interest) within 10

business days after we received your claim and the remainder of your refund (plus interest if your Account earns interest) not later

than 45 calendar days after we received your claim.

We may reverse the refund (including any interest on the refund) if we later are able to demonstrate that the substitute check was

correctly posted to your Account.

THE FOLLOWING APPLIES TO CONSUMER ACCOUNTS ONLY

How should you as a consumer make a claim for a refund?

If you believe that you have suffered a loss relating to a substitute check that you received and that was posted to your Account,

please contact us by calling Laurel Road customer service at 1-833-427-2265 (for clients using a TDD/TTY device, please call 1-

800-539-8336) or write: Laurel Road P.O. Box 191, Bridgeport, CT 06601.

You must contact us within 40 calendar days of the date that we mailed (or otherwise delivered by a means to which you agreed)

the substitute check in question or the Account statement showing that the substitute check was posted to your Account, whichever

is later. We will extend this time period if you were not able to make a timely claim because of extraordinary circumstances.

Your claim must include-

•

A description of why you have suffered a loss (for example, you think the amount withdrawn was incorrect);

•

An estimate of the amount of your loss;

•

An explanation of why the substitute check you received is insufficient to confirm that you suffered a loss; and

•

A copy of the substitute check and the following information to help us identify the substitute check: (identifying information, for

example the check number, the Account number, your name, the name of the person to whom you wrote the check, the

amount of the check and the posting date the check appears on your statement).

If you tell us orally, we may require that you send us your request for a refund in writing by the 10th business day after the banking

day on which the bank received your oral notice. We will tell you the results of our investigation within 10 business days after we

hear from you. If we need more time, however we may take up to 45 calendar days to investigate your claim. If we ask you to put

your request for a refund in writing and we do not receive it within 10 business days, we may not credit your Account. We will tell

you the results no later than the business day after the banking day we complete our investigation. If we decide your claim is not

valid, we will send you a written explanation. You may ask for copies of the documents that we used in our investigation.

7.

Stopping Payment. You can ask us to stop payment on a check drawn on your Account. In order to place a stop payment

request, you must inform us of the exact amount of the item, the number of the check, the date of the check, the Account number,

and any other information we may request. A stop payment confirmation will be mailed to you. You must review the specific details

on the confirmation for accuracy and call us immediately if any of the information is not accurate. A stop payment request is

effective for only six (6) months, unless you specifically request the stop payment be effective for 12 months. You may renew a stop

payment prior to its expiration. Refer to the Deposit Account Fees and Disclosures for stop payment fee details. We are not liable for

payment of a check or other item if a stop payment request has expired and not been renewed. In some states and under certain

limited circumstances, you may stop payment on official checks and on certified checks.

072023COMP-896

We are not liable for failing to stop payment if you have not given us sufficient information or if your stop payment request comes too

late for us to act on it. We are entitled to a reasonable period of time after we receive your stop payment request to notify our

employees and take other action needed to stop payment. You agree that "reasonable time" depends on the circumstances but that

we will have acted within a reasonable time if we make your stop payment request effective by the end of the next business day

following the business day on which we receive your stop payment request. If we stop payment, you agree to defend and pay any

claims raised against us as a result of our refusal to pay the check or other item on which you stopped payment.

If we recredit your Account after we have paid a check or other item over a valid and timely stop order, you agree to sign a

statement describing the dispute you have with the person to whom the check or item was made payable. You also agree to transfer

to us all of your rights against the payee and any other holder, endorser or prior transferee of the check or item and to cooperate

with us in any legal action taken to collect against the other person(s).

If we are liable for inadvertently paying your check over a stop payment order, you must establish the amount of your loss caused by

our payment of the check. We will pay you only the amount of the loss, up to the face amount of the check.

You may request us to stop payment of electronic fund transfers from your Account. You must refer to other agreements and

disclosures for information regarding stopping payment on electronic fund transfers.

8.

Account Disclosure and Fees. When you opened your Account, we gave you disclosures containing additional terms and

conditions relating to your Account and listing fees that may be payable to us. You agree to comply with the terms and conditions

disclosed and to pay us the fees and charges imposed by us on your Account. We can deduct any or all these fees and charges

from your Account. We are not liable for dishonoring or declining to pay a check or other item drawn on or payable from your

Account if your Account does not contain sufficient "available" funds as a result of our deducting fees and charges from your

Account. We can change these fees at any time. We will give you prior notice of the change if we are required to do so under

applicable law.

All fees are "deposit account service charges" under Title 12, Code of Federal Regulations, Section 7.4002 (12 C.F.R. section

7.4002). These fees are assessed for the inconvenience and additional administrative resources that we incur or require to provide

the associated services. All fees charged in connection with an overdraft are designed to deter you from overdrawing your account

and/or allowing such overdrafts to continue and thus to maintain the safety and soundness of our operations. No loan or extension

of credit is or is intended to be established by our honoring of an overdraft. On certain Accounts, an overdraft line of credit is

available. Please contact us for additional information if you are interested in an overdraft line of credit.

9.

Signature Cards and Resolutions; No Two Signer Accounts. We are entitled to rely upon and treat as genuine the names,

titles and signatures shown on any Account signature cards and Account Express Plan, or other written documentation acceptable

to us, delivered by you or your officers, employees or agents on your behalf, unless you notify us otherwise in writing. If we require

you to deliver certified copies of resolutions or sign our depository resolutions to open an Account, we are entitled to rely upon such

resolutions and certifications, without investigation by us, unless you or your authorized representative notify us otherwise in writing.

You agree that we can pay checks drawn on your Account and made payable to any of your officers, partners, employees or agents

and we may cash and pay such checks without inquiring about the authority of the payee or person who signed the check on your

behalf. Subject to the statement review provisions contained in Section 10 below, if the signature cards or resolutions related to your

Account are unavailable for any reason, you agree that we can rely upon the titling contained in your most recent Account

Statement for purposes of determining the ownership of the Account.

We do not offer Accounts on which two signatures are required for a check or other withdrawal. Notwithstanding any provisions to

the contrary on any signature card or other agreement you have with us, you agree that if any Account purports to require two or

more signers on items drawn on the Account, such provision is solely for your internal control purposes and is not binding on us. If

more than one person is authorized to write checks or draw items on your Account, you agree that we can honor checks signed by

any authorized signer, even if there are two or more lines on the items for your signature and two signatures are required.

10.

Account Statements; Limitation on Time to Report Unauthorized Transactions, Forgeries and Errors. You should review

and balance your Account statements promptly after you receive them or, if we are holding them for you, promptly after we make

them available to you. If you don't receive an Account statement by the date when you usually receive it, call us at once. We will not

mail a paper monthly statement if there is no activity on the account during that statement period. However, you will receive a

deposit account statement quarterly, even if there is no activity during that period. This is not applicable to you if you currently

receive quarterly statements, a monthly paper combined statement or an online electronic monthly statement. You must review your

statements to make sure that there are no errors in the Account information. You agree that if you give out your Account number to

a third party, such act authorizes the recipient of the information to initiate debits to your Account, whether or not you have

authorized the particular debit.

On Accounts with check-writing privileges, you must review your statement and any canceled checks we send you and report

unauthorized transactions including forgeries, alterations, missing signatures, amounts differing from your records, or other

information which might lead you to conclude that a transaction was not authorized or a check was forged or that, when we paid the

check, the proper amount was not paid to the proper person. You have this duty even if we do not return checks to you or we return

only an image of the check. You should notify us as soon as possible if you think there is a problem.

If we are holding your Account statements for you at your request, the statements become "available" on the day they are available

for you to pick up. This means, for example, that the period in which you must report any problem with an Account begins on the day

we make the statement available, even if you do not pick up the statement until later.

Because of the high volume of items, we must process and the largely automated nature of such processing, you agree that we will

not be considered to have failed to exercise ordinary care if we do not manually examine all items. All checks, withdrawal forms, and

deposit slips must be on forms obtained through us or which we approve in advance. You are responsible for verifying the accuracy

of all information on such forms. Our liability, if any, for any printing errors on forms obtained through us is limited to the cost of

072023COMP-896

replacement of such forms. We are not responsible for errors or losses you may incur due to improper printing on forms not

obtained through us or approved by us in advance.

If you choose to use a facsimile signature device, you agree that we are not liable for honoring checks bearing facsimile signatures

or facsimile endorsements. You agree to indemnify us and hold us harmless from any claims related to the use of a facsimile

signature device. This means we will not recredit your Account if your facsimile signature is forged or use of the facsimile device

was unauthorized.

If you have made arrangements with us to review electronic information about checks presented for payment, we are not liable for

any errors or problems with checks you authorize us to pay. You agree that we will not be considered negligent in paying checks

presented to us electronically through normal banking channels prior to receiving the actual check or paying checks even if we do

not check the signature on the checks we pay.

If you assert against us a claim that a transaction was not authorized or an item was not properly payable because, for example, the

item was forged or an endorsement was forged, you must cooperate with us and assist us in seeking criminal and civil penalties

against the person responsible. You must file reports and complaints with the appropriate law enforcement authorities and promptly

provide us with copies of such reports and complaints. You must also give us a statement, under oath, about the facts and

circumstances relating to your claim. If you fail or refuse to do these things, we will consider that you have ratified the defect in the

item and agree that we can charge the full amount of the item to your Account.

You must notify us as soon as possible after receiving your Account statement if you believe there is an error or

irregularity of any kind, including any unauthorized transaction or signature, lack of signature or alteration. You agree that

thirty (30) days after we mailed a statement (or otherwise made it available to you) is a reasonable amount of time for you

to review your Account statement and report any errors or other irregularities. In addition, by law we may be relieved of

any potential liability for multiple unauthorized signatures or alterations by the same wrongdoer if you do not notify us in

writing within thirty (30) days after your statement containing the first such irregularity was mailed or otherwise made

available to you. Similarly, by law we may be relieved of any potential liability for losses arising due to your negligence.

You agree that failure to report any error or irregularity in writing within thirty (30) days after we mailed your statement (or

otherwise made it available to you) shall preclude you from recovering any amounts from us. No legal proceeding or

action shall be brought by you against us to recover any amount alleged to have been improperly paid out of the Account

(as well as related losses) due to an unauthorized transaction or signature, alteration or other defect unless (1) you have

given the written notice provided above, and (2) such action shall have been commenced within the time required by

applicable law. Transactions involving electronic fund transfers may be governed by the Electronic Fund Transfer Act and

may be subject to Laurel Road's Disclosure Statement and Terms and Conditions for Electronic Fund Transfer

Transactions.

You may not deposit remotely created checks (items not bearing the maker's signature but purporting to be authorized by the

maker) to an account with us without our prior, express written consent. This provision does not apply to checks created on your

behalf by the paying bank. If you deposit remotely created checks with us, you agree that we may withhold a portion of the proceeds

of such drafts or other funds in your Accounts in a reserve account, in an amount that we reasonably believe may be needed to

cover future chargebacks, returned items, and/or claims that such drafts were unauthorized. You grant us a security interest in the

reserve account. Unless we agree otherwise in writing with you, reserve funds shall not bear interest. Our rights to charge your

Account for returned remotely created checks will not be limited by the balance or existence of any reserve. Our rights with respect

to the reserve, as well as the security interest granted to us, shall survive the termination of this Agreement. We may discontinue

accepting remotely created checks at any time without cause or prior notice.

Upon your authorization, or to the extent permitted by law, we may at our option send or otherwise make available your statements

in an electronic medium, rather than mailing you a paper-based statement.

11.

Time Account Certificates. All of the Time Accounts we currently offer are "book entry" Accounts, which means that the Time

Account is owned by the person(s) shown on our records, and no certificate is issued by us on the Account. All Time Accounts are

non-negotiable and non-transferable. We formerly issued certificates on some Time Accounts and, if we issued a certificate on your

Time Account, you must present the certificate in order to make a withdrawal or close the Account. You should notify us at once if

your certificate is lost or stolen. At our option, you must give us a bond from a surety company satisfactory to us in an amount not

exceeding the balance in the Account, or other satisfactory indemnity, if you close a certificate Account without giving us the

certificate.

12.

Joint Personal Accounts; Survivorship Accounts. For Personal Accounts, if there are more than one of you, your Accounts

are "joint Accounts." All deposits in joint Accounts are the property of each owner as joint tenants with rights of survivorship. While

all owners are alive, we can honor checks or orders drawn by any owner, honor requests for withdrawals from any owner, release

the entire amount on deposit in the joint Account to any owner, allow any owner to close the joint Account, and allow any owner to

take all actions that a sole owner could take. Any owner can pledge the joint Account as security or grant a power of attorney to

appoint an attorney-in-fact. However, we reserve the right to require the consent and signatures of all joint Account owners to take

these actions. Each of you appoints all of the other owners as your true and lawful agents and attorneys-in-fact to conduct any and

all banking business relating to your joint Accounts. Each of you also agrees that any other joint owner may endorse your name on

any check made payable to you for all purposes, including depositing the check in your joint Account.

You agree that we can follow the directions given, and take action requested by, any owner, even if the directions or actions to be

taken are inconsistent with directions or instructions to act given by another owner. We are not liable for continuing to honor checks

or other orders drawn on the joint Account by any owner or withdrawals made by any owner even after receiving notice from another

owner not to do so. If we do receive notice, we may, but are not obligated to, refuse to honor any checks, orders or withdrawals from

the joint Account unless all owners agree in writing. You agree that we can place a hold on funds in your joint Account or pay funds

from your joint Account if we receive a garnishment, levy or other governmental order directed against any owner, even if the funds

in the joint Account were not deposited by the owner against whom the order is directed.

072023COMP-896

For joint Accounts "with rights of survivorship" while all owners are living, each joint owner has the rights described above for joint

Accounts. When any owner dies, the amounts on deposit in the joint Account pass to the surviving owners. The right of any survivor

to obtain his or her share of the deceased owner's funds in a joint Account is subject to our right of set-off and the rights of any

person (including us) that holds a security interest in or has any claim to funds in the joint Account.

On all joint Accounts, whether or not "with rights of survivorship," we may honor checks, orders, or requests for withdrawals from the

surviving owners after the death of an owner. On joint Accounts without rights of survivorship, we may also honor checks, orders, or

requests for withdrawals from the personal representative or legal successor of the deceased owner.

13.

Payable on Death Accounts. In some states we offer Personal Accounts that are payable on death ("POD"). POD Accounts

permit you to designate one or more beneficiaries to receive the funds on deposit in an Account after your death. Until your death,

you are the owner of the Account, and the beneficiary has no present, vested interest in the Account. You can change a beneficiary

at any time. The beneficiary's right to receive the funds in the Account after your death is subject to our right of set-off and to the

rights of any person (including us) that holds a security interest in or has any claim to the funds in your Account. On joint POD

Accounts, the beneficiary's right to receive the deceased owner's share is subordinate to the surviving owners' rights and the

beneficiary will not receive any funds unless all Account owners are deceased. In order to designate a beneficiary, a designation of

beneficiary form must be completed and signed by you. If no beneficiary form is available, we will presume that no designation of

POD exists.

14.

Fiduciary and Custody Accounts. Trust Accounts and custody Accounts are fiduciary Accounts in which funds are held by a

trustee or custodian for the benefit of another person. We offer a variety of these types of Accounts were permitted by applicable

law.

An "in trust for" Account is an Account in which you name yourself as trustee in trust for one or more persons without otherwise

establishing a written trust agreement. As with POD Accounts, you are the owner of the Account and the persons you name are

considered beneficiaries and have no right to receive funds in the Account until all owners are deceased. The beneficiary's right to

receive funds in the Account is subordinate to the rights of any other person (including us) that holds a security interest in or has a

claim to the funds in the Account.

A Uniform Gift to Minors Act/Uniform Transfers to Minors Act ("UGMA/UTMA") Account is an Account established under a state law

governing gifts or transfers to minors. In general, state law treats the minor as the owner of the Account and the custodian or trustee

must hold funds in the Account solely for the benefit of the minor. State laws may restrict the trustee's or custodian's rights to use or

withdraw the funds, regulate the appointment of a successor trustee/custodian and require the distribution of funds to the minor

when the minor reaches a certain age. You must comply with all of these rules in order to maintain a UGMA/UTMA Account.

Some states have specific laws governing other specific types of fiduciary Accounts, such as Lawyer Trust Accounts. If you

establish one of these types of Accounts, you agree to comply with all of the laws applicable to such types of Accounts.

With all fiduciary and custody Accounts, the owners and beneficiaries of the Account agree that we will not be liable if the trustee or

custodian commits a breach of trust or breach of fiduciary duty or fails to comply with the terms of a written trust agreement or

comply with applicable law. We are not responsible for enforcing the terms of any written trust agreement or applicable law against

the trustee or custodian and can rely on the genuineness of any document delivered to us, and the truthfulness of any statement

made to us, by a trustee or custodian.

15.

Powers of Attorney. A power of attorney gives a person you designate as your "attorney-in-fact" the power to handle your

affairs on your behalf while you are alive. For joint Accounts, we may require the consent and signatures of all Account owners in

order to appoint an attorney-in-fact. All owners of the Account will be bound by any actions taken by the attorney-in-fact in

connection with the Account. We do not honor powers of attorney on Business Accounts or Accounts owned by corporations,

associations, partnerships, limited liability companies or on Accounts owned by fiduciaries. On other Accounts, we reserve the right

not to honor powers of attorney. We will not honor a power of attorney unless it is in a form acceptable to us. We will not honor

powers of attorney that do not survive your disability or declared incompetence, or that have limits on the time the power of attorney

is in effect. We also will not honor any general power of attorney that does not specifically include detailed provisions granting the

power to conduct all banking business on your behalf. If we decide to honor a power of attorney, we can later decide not to honor it

any longer. Any attorney-in-fact appointed by you is subject to this Agreement.

16.

Closing Accounts. We reserve the right to close any or all of your Accounts at any time for any reason whatsoever, including,

but not limited to, because you have an excessive number or amount of overdrafts or your account is overdrawn for more than 10

days or if there is a zero balance and no activity for a period of thirty (30) days. If we do so, we will return the balance in the Account

(less any amounts owed to us) to you by mailing a check to you at the address listed on our records. Subject to our right to require

prior notice of withdrawal on some Accounts as described above, you may close any or all of your Checking Accounts or Savings

Accounts at any time for any reason whatsoever.

If an Account is closed, you remain liable for all fees and charges incurred through the date the Account is closed. You also remain

liable for all checks and electronic funds transfers drawn on the Account that have not been presented to us for payment and

deducted from the Account prior to the time the Account is closed. We are not required to pay you interest that has accrued but not

been credited to your Account prior to the date the Account is closed.

17.

Inactive Accounts/Unclaimed Funds. We will consider a Checking Account inactive when there is no client-initiated activity

within 3 consecutive months. Savings Accounts are considered inactive when there is no client-initiated activity within 12

consecutive months. If your Checking Account or Savings Account is inactive, we may, in our discretion, decide not to pay checks or

honor other requests for withdrawals on the Account until we receive proof that you have signed the checks or authorized the

withdrawal. For Time Accounts that are auto-renewing, the applicable period according to state law for determining whether there

has been activity commences at the expiration of its initial term. The start of a new term does not constitute activity in the absence of

other activity.

072023COMP-896

State law requires us to transfer the balance in all Accounts to a state agency after a certain period of no withdrawals, deposits or

other activity on the Account and no contact with the Account owner. Accounts will be escheated as unclaimed funds pursuant to

applicable state law. If this happens to your Account, you must file a claim with the state agency to recover the funds. We are not

liable for funds transferred to the state agency.

18.

Death/Incompetence. Your death, or a declaration that you are legally incompetent to handle your affairs, does not end our

authority to pay checks signed by you, to accept deposits or to collect items deposited until we receive written notice of your death

or declared incompetence. Even after we receive notice, we can pay checks drawn by you before your death or declared

incompetence for up to ten (10) days or any longer period permitted under applicable law.

On joint Accounts, your death or declared incompetence does not affect the rights of any other owner of the Account to make

deposits, make withdrawals or, if applicable, write checks. We may require the surviving owners and any POD beneficiary to provide

reasonable proof of your death or incompetence and, in some states, provide any tax releases or other documents or consents

needed from government authorities before we pay any checks drawn on your joint Account or allow the surviving owners or your

beneficiary to withdraw any funds from the Account. Each of you is responsible for notifying us when any other joint owner of an

Account dies.

Checks or other items made payable to a deceased joint Account holder (e.g. Social Security checks or electronic deposits) must be

returned to the issuer and may not be used, cashed or disposed of in any other way by the surviving Account holders. If such items

are used, cashed or disposed of by any one or all of the surviving Account holders each Account holder remains liable for the

amount of the item and any charges incurred as a result of the improper use of the item. In our discretion, we can charge your

Account for the amount of these items and remit payment to the issuer of the item.

19.

Our Right of Set-off. We reserve the right to withdraw at any time some or all of the funds that may now or later be on deposit

in any or all of your Accounts and apply them to the payment of any debts (other than amounts you may owe us on a personal credit

card account with us) you may now or later owe us. We also have the right to set-off against any direct deposit from the federal

government to which you are not entitled to. We have this right even if the Account(s) we withdraw money from is a joint Account

and the debt we apply it to is owed by only one of you. Likewise, we could withdraw money from an Account owned by only one

person and apply it to reduce the joint debt of that person and another person. Our rights under this section are in addition to any

right of set-off we may have under applicable law. You agree that our right of set-off is not conditioned on, or limited by, the

complete mutuality of the parties obligated on the debt and owners on your Account, the maturity of the debt, the giving of notice to

you, or the availability of any collateral securing the debt.

We also have the right to place a hold on funds in your Accounts if we have a claim against you or pending exercise of our right of

set-off. If we place a hold on your Account, you may not withdraw funds from the Account, and we can refuse to pay checks drawn

on the Account.

20.

Adverse Claims; Interpleader; Legal Process. We need not honor any claim against or involving an Account unless we are

required to do so by order of a court or governmental agency that has jurisdiction over us. This rule applies to any person asserting

any rights or interest regarding an Account, including you and other persons who are authorized to make withdrawals or write

checks or who present a power of attorney signed by you.

If we receive notice of any claim or dispute or of any legal proceeding, we reasonably believe involves you or any of your Accounts,

in our discretion we may suspend transactions on any Account which we believe to be affected until final determination of the claim

or proceeding. We may place a hold on any funds in the Account and suspend transactions whether the affected Account is in your

name alone or is a joint Account. Suspension of transactions may, in our discretion, involve placing a hold on any funds in the

affected Account or transferring funds from the affected Account to a separate suspension account throughout the pendency of the

claim, dispute, or legal proceeding. An Account may be suspended even though the suspension may have been due to

inadvertence, error because of similarity of the names of depositors, or other mistake. We also may act upon any notice of

garnishment, levy, restraining order, injunction, subpoena or other legal process we reasonably believe to be valid, without

independent verification by us. You agree that we are not liable for any damages or losses (including claims based on the return or

dishonor of checks) to you caused by the suspension of your Account or action taken in response to legal process, as long as we

acted in good faith.

You agree to indemnify us against all losses, costs, attorneys' fees, and any other liabilities that we incur by reason of responding to

or initiating any legal action, including any interpleader action we commence, involving you or your Account. As part of that

indemnity, in the event we incur liability to a creditor of yours as a result of our response or failure to respond to a legal action, you

agree to pay us on demand the amount of our liability to your creditor and to reimburse us for any expense, attorneys' fees, or other

costs we may incur in collecting that amount from you.

We may, in our sole discretion and without any liability to you, initiate an action in interpleader to determine the rights of persons

making adverse claims to your Account. We may exercise this right regardless of whether the persons making the adverse claims

have complied with all statutory requirements pertaining to adverse claims, such as posting a bond or giving other surety. Upon

initiation of an interpleader action, we will be relieved and discharged of all further duties and obligations. You agree that any costs

associated with the action in interpleader will be charged against any Accounts you maintain with us.

21.

Assignment; Pledge. You cannot assign or transfer your Account, or pledge your Account as collateral for a loan, without our

written consent. We can withhold our consent for any reason. With our consent, any joint owner can pledge the entire Account as

collateral for a loan. If we permit you or a joint owner to pledge your Account as collateral for a loan from us, you agree that if the

person who pledged the Account dies, we can apply the balance in the Account to pay off the loan. You agree that we have this right

even if your Account is a joint Account with rights of survivorship or if you have a POD or an "in trust for" Account and have named a

beneficiary or beneficiaries to receive your Account balance upon your death.

22.

Waiver of Notices. We send periodic statements to you on most Checking Accounts and Savings Accounts to show activity on

your Account, including any returned items or other credit and debit entries. You agree that these statements are sufficient notice to

072023COMP-896

you and you waive any right to receive any other notice that may be required under clearinghouse rules, the Uniform Commercial

Code or other state or federal laws (other than the federal Electronic Funds Transfer Act and the federal Truth in Savings Act).

23.

Check Cashing. You may be required to provide positive identification when you present a check for payment. We may also

limit the dollar amount of checks cashed. We provide check cashing privileges only to our customers. We reserve the right to

charge a fee to a non-customer if we decide to cash a check for the non-customer, even if the check is drawn on us. You agree that

the charging of such fee is not considered wrongful dishonor. Positive identification for a non-customer shall include the non-

customer’s thumbprint in most states.

24.

Addresses; Notices. You agree that if we need to contact you or send you any written (paper-based) information (such as

notices, Account statements, checks payable to you, or other communications), we can do so by mail addressed to any of you at the

Postal Service address in our records or, at our option, by electronic communication(s) either authorized by you or permitted by law

and transmitted by us to your e-mail address in our records. Unless the communication states another effective date, any paper-

based communication we send you is effective when mailed to your Postal Service address by delivery to the mail service provider,

and any electronic communication we send you is effective when transmitted by us to your e-mail service provider. You must notify

us promptly in writing, or by e-mail with written confirmation mailed within five (5) days, if you change your Postal Service or e-mail

address or if your e-mail service provider is no longer providing e-mail service for you. In no event shall we have any responsibility,

and you hereby release us from all claims and liabilities, for any actions or omissions by you or your e-mail service provider in

handling e-mail to or from you, or for any failure in computer hardware, software, or communications lines not maintained by us or

under our control.

25.

Arbitration Provision. This Arbitration Provision sets forth the circumstances and procedures under which a Claim or Claims

(as defined below) may be arbitrated instead of litigated in court. This Arbitration Provision supersedes and replaces any existing

arbitration provision between you and us. This Arbitration Provision will apply to your Account(s) unless you notify us in

writing that you reject the Arbitration Provision within 60 days of opening your Account(s). Send your rejection notice to

KeyBank National Association, P.O. Box 93752, Cleveland, Ohio 44101-5752. Your notice must include your name, the

names of any joint account holders and your Account number(s) and must be signed by at least one of the joint account

holders. Your rejection notice should not include any other correspondence. Calling us to reject the Arbitration Provision

or providing notice by any other manner or format than as described above will not operate as a rejection of this

Arbitration Provision and consequently this Arbitration Provision will become part of this Agreement. Rejection of this

Arbitration Provision does not serve as rejection of any other term or condition of your Agreement with us governing your

Account(s).

As used in this Arbitration Provision, the word "Claim" or "Claims" means any claim, dispute, or controversy between you and us

arising from or relating to this Agreement or your Account(s), including, without limitation, the validity, enforceability, or scope of this

Arbitration Provision or this Deposit Account Agreement. "Claim" or "Claims" includes claims of every kind and nature, whether pre-

existing, present, or future, including, without limitation, initial claims, counterclaims, cross-claims, and third-party claims, and claims

based upon contract, tort, fraud and other intentional torts, constitutions, statute, regulation, common law, and equity (including,

without limitation, any claim for injunctive or declaratory relief). The word "Claim" or "Claims" is to be given the broadest possible

meaning and includes, by way of example and without limitation, any claim, dispute, or controversy that arises from or relates to (a)

any Account subject to the terms of this Agreement (b) any electronic funds transfer from or to any account, (c) advertisements,

promotions, or oral or written statements related to this Agreement or your Account, (d) your application for any Account, and (e) the

collection of amounts owed by you to us. Notwithstanding this arbitration provision, if you have a Claim that is within the jurisdiction

of the small claims court or your state’s equivalent court, you may file your Claim there. If that Claim is transferred, removed or

appealed to a different court, then we have the right to choose arbitration.

This Arbitration Provision will not apply to Claims previously asserted, or which are later asserted, in lawsuits filed before the

effective date of this Arbitration Provision or any prior arbitration provision between you and us, whichever is earlier. However, this

Arbitration Provision will apply to all other Claims, even if the facts and circumstances giving rise to the Claims existed before the

effective date of this Arbitration Provision.

Any Claim shall be resolved, upon the election of you or us, by binding arbitration pursuant to this Arbitration Provision and the

applicable rules of either the American Arbitration Association or J.A.M.S/Endispute in effect at the time the Claim is filed (the

"Arbitration Rules"). You may select one of these organizations to serve as the arbitration administrator if you initiate an arbitration

against us or if either you or we compel arbitration of a Claim that the other party has brought in court. In addition, if we intend to

initiate an arbitration against you, we will notify you in writing and give you twenty (20) days to select one of these organizations to

serve as the arbitration administrator; if you fail to select an administrator within that twenty (20)-day period, we will select one. In all

cases, the arbitrator(s) should be a lawyer with more than ten (10) years of experience or a retired judge. If for any reason the

selected organization is unable or unwilling or ceases to serve as the arbitration administrator, you will have twenty (20) days to

select a different administrator from the above list; if you fail to select a different administrator within the twenty (20)-day period, we

will select one. In all cases, a party who has asserted a Claim in a lawsuit in court may elect arbitration with respect to any Claim(s)

subsequently asserted in that lawsuit by any other party or parties.

IF ARBITRATION IS CHOSEN BY ANY PARTY WITH RESPECT TO A CLAIM, NEITHER YOU NOR WE WILL HAVE THE

RIGHT TO LITIGATE THAT CLAIM IN COURT OR HAVE A JURY TRIAL ON THAT CLAIM, OR TO ENGAGE IN PRE-

ARBITRATION DISCOVERY EXCEPT AS PROVIDED FOR IN THE APPLICABLE ARBITRATION RULES. FURTHER, YOU

WILL NOT HAVE THE RIGHT TO PARTICIPATE AS A REPRESENTATIVE OR MEMBER OF ANY CLASS OF CLAIMANTS

PERTAINING TO ANY CLAIM SUBJECT TO ARBITRATION. EXCEPT AS SET FORTH BELOW, THE ARBITRATOR'S

DECISION WILL BE FINAL AND BINDING. YOU UNDERSTAND THAT OTHER RIGHTS THAT YOU WOULD HAVE IF YOU

WENT TO COURT MAY ALSO NOT BE AVAILABLE IN ARBITRATION. THE FEES CHARGED BY THE ARBITRATION

ADMINISTRATOR MAY BE GREATER THAN THE FEES CHARGED BY A COURT.

There shall be no authority for any Claims to be arbitrated on a class action or private attorney general basis. Furthermore,

arbitration can only decide your or our Claim(s) and may not consolidate or join the claims of other persons that may have similar

072023COMP-896

claims. There shall be no pre-arbitration discovery except as provided for in the applicable Arbitration Rules. Any arbitration hearing

that you attend shall take place in the federal judicial district of your residence. At your written request, we will pay all fees charged

by the arbitration administrator for any Claim(s) asserted by you in the arbitration, after you have paid an amount equivalent to the

fee, if any, for filing such Claim(s) in state or federal court (whichever is less) in the judicial district in which you reside. (If you have

already paid a filing fee for asserting the Claim(s) in court, you will not be required to pay that amount again.) If the arbitrator issues

an award in our favor, you will not be required to reimburse us for any of the fees we have previously paid to the administrator or for

which we are responsible. Each party shall bear the expense of that party's attorneys', experts', and witness fees, regardless of

which party prevails in the arbitration, unless applicable law and/or this Agreement gives you the right to recover any of those fees

from Us. In the event you do not prevail in the arbitration, we will not seek to recover our attorneys', experts' or witness fees from

you. This Arbitration Provision is made pursuant to a transaction involving interstate commerce, and shall be governed by the

Federal Arbitration Act ("FAA"), 9 U.S.C. Sections 1 et seq. The arbitrator shall apply applicable substantive law consistent with the

FAA and applicable statutes of limitations and shall honor claims of privilege recognized at law and, at the timely request of any

party, shall provide a brief written explanation of the basis for the award. In conducting the arbitration proceeding, the arbitrator shall

not

appl