Updated: November 16, 2023 Page 1 of 3

U.S. Department of Justice

Office of the United States Trustee

AUTHORIZED DEPOSITORIES IN REGION 2 AND

AUTHORIZED DEPOSITORIES SPECIFIC TO REGION 2 FIELD OFFICES

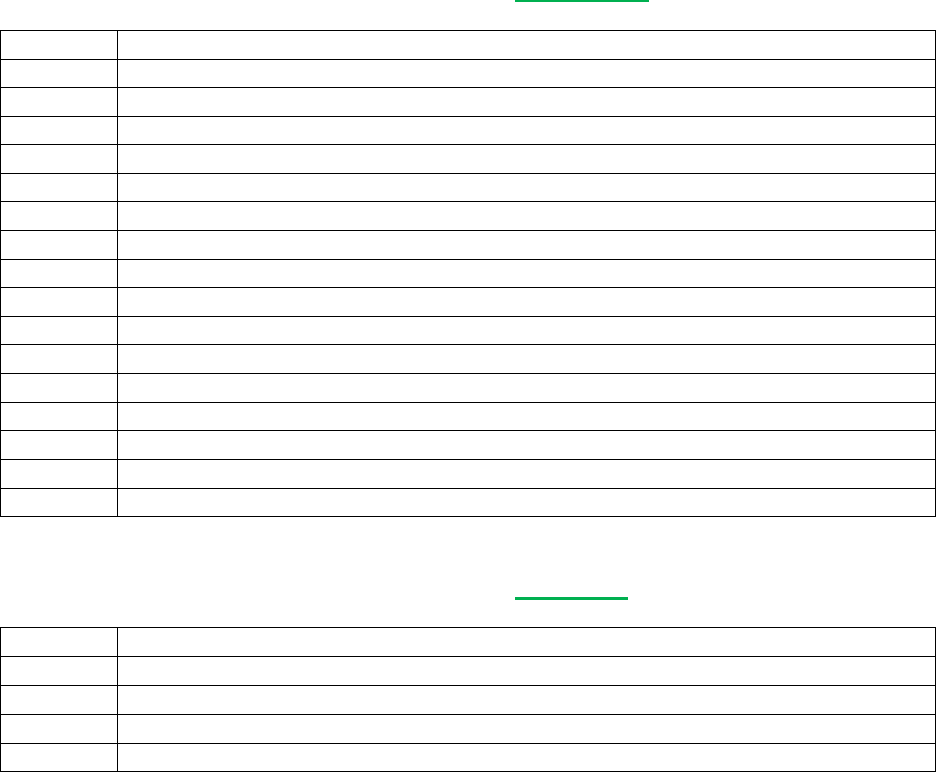

AUTHORIZED DEPOSITORIES FOR ALL OFFICES IN REGION 2:

1.

Axos Bank

2.

Banc of California

3.

Bank of America *

4.

BankUnited, N.A.

5.

BOFK, N.A. (Bank of Oklahoma and Bank of Texas)

6.

Cadence Bank

7.

California Republic Bank

8.

Capital One, N.A.

9.

Citibank, N.A. **

10.

Citizens Bank. N.A.

11.

City National, N.A.

12.

ConnectOne Bank

13.

Dime Community Bank

14.

East West Bank

15.

Emigrant Mercantile Bank

16.

First-Citizens Bank & Trust Company

17.

Flagstar Bank, N.A. (formerly Signature Bank)

18.

HSBC

19.

JP Morgan Chase *

20.

Keybank, N.A.

21.

M&T Bank

22.

Metropolitan Commercial Bank

23.

New York Community Bank

24.

Pinnacle Bank

25.

PNC Bank, N.A.

26.

TD Bank, N.A.

27.

Texas Capital Bank ***

28.

Tompkins Community Bank

29.

TriState Capital Bank

30.

Truist Bank

31.

Valley National Bank

32.

Veritex Community Bank (f/k/a Green Bank N.A.)

33.

Webster Bank, N.A.

34.

Western Alliance Bank a/k/a Alliance Bank of Arizona

35.

Wilmington Savings Fund Society, FSB

36.

ZB, N.A. (Zion Bank, Zions First National Bank, Amegy Bank)

Updated: November 16, 2023 Page 2 of 3

*Bank of America and JP Morgan Chase: These institutions are not opening DIP Bank Accounts for a Small

Business, however, based on the Debtors relationship with the bank they will consider opening the DIP Bank

Account. On Mega Cases they are fully collateralizing all bankruptcy funds.

**Citibank, N.A.: This institution is not opening DIP Bank Accounts for a Small Business. On Mega Cases, the

Debtor must check with Citibank to ensure that they will collateralize the funds with the Federal Reserve or obtain a

surety bond to cover the bankruptcy funds.

***Texas Capital Bank. N.A.: This institution restricts DIP bank accounts to Chapter 11 customers who have pre-

existing commercial relationships with the bank (i.e. prior to filing). In addition, the opening of bankruptcy

accounts is subject to executive Management approval.

****Citizens Bank, N.A.: This institution has reserved the right to require new bankruptcy accounts to be subject

to management approval and any case accounts may be required to reach a threshold of at least $10,000.

AUTHORIZED DEPOSITORIES SPECIFIC TO SOUTHERN DISTRICT OF NEW

YORK (MANHATTAN, WHITE PLAINS, POUGHKEEPSIE):

1.

Alma Bank

2.

Banco Popular North America (aka Popular Bank)

3.

Bank Hapoalim, B. M.

4.

Comerica Bank

5.

Commerce Bank

6.

Fifth Third Bank

7.

Flushing Bank

8.

Integrity Bank

9.

Israel Discount Bank

10.

MidFirst Bank

11.

Regions Bank. N.A.

12.

Republic First Bank a/k/a Republic Bank

13.

The First National Bank of Long Island

14.

The Private Bank (Chicago)

15.

UMB Bank

16.

US Bank, N. A. (Union Bank merger 5/2023)

17.

Wells Fargo Bank, N.A.

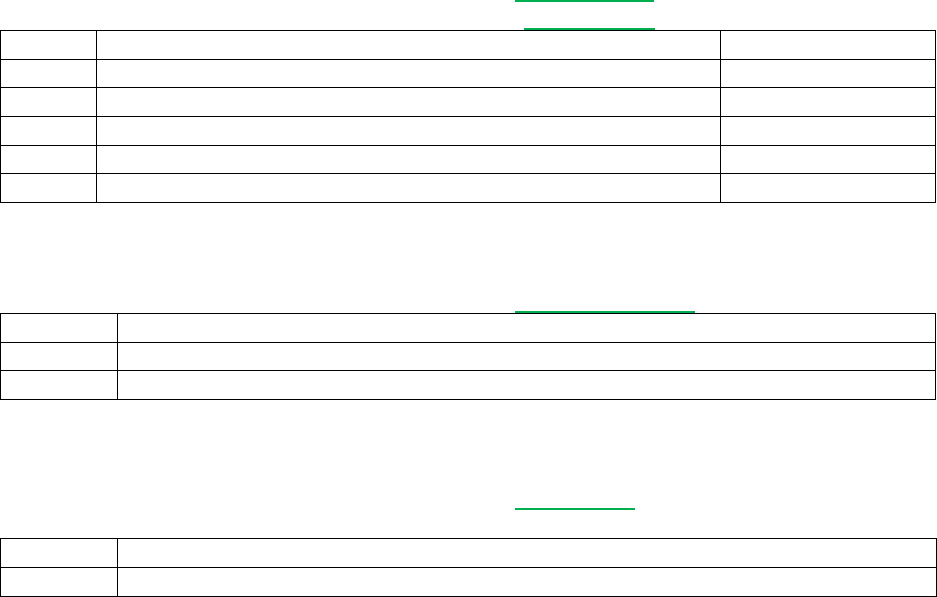

AUTHORIZED DEPOSITORIES SPECIFIC TO EASTERN DISTRICT OF NEW YORK

(BROOKLYN, CENTRAL ISLIP, QUEENS, STATEN ISLAND):

1.

Banco Popular North America (aka Popular Bank)

2.

Flushing Bank

3.

Israel Discount Bank

4.

The First National Bank of Long Island

5.

Wells Fargo Bank, N.A.

Updated: November 16, 2023 Page 3 of 3

AUTHORIZED DEPOSITORIES SPECIFIC TO NORTHERN DISTRICT OF NEW

YORK (ALBANY AND UTICA) & DISTRICT OF VERMONT:

1.

Chemung Canal Trust Co. – NDNY cases

2.

Merchants Bank – VERMONT cases

3.

NBT Bank, N.A. – NDNY cases

4.

Passumpsic Savings Bank – VERMONT cases

5.

Provident Bank – NDNY cases

6.

TrustCo Bank – NDNY cases

AUTHORIZED DEPOSITORIES SPECIFIC TO CONNECTICUT:

1.

Fifth Third Bank

2.

Regions Bank

3.

Wells Fargo Bank, N.A.

AUTHORIZED DEPOSITORIES SPECIFIC TO WESTERN DISTRICT OF NEW

YORK (ROCHESTER AND BUFFALO):

1.

Regions Bank, N.A.

2.

Wells Fargo Bank, N.A.