in association with

Arranged by

policy document

camper insurance

Quality cover for

people on the move

NI November, 2018

In the event of a claim

please call our 24 hour

Claims Helpline on:

03458 282823

+0044 3458 282823 (from outside NI)

1

camper insurance CONTENTS

Your policy 2

Caring for you 3

Definitions 4

Section 1 - Loss of or Damage to your vehicle 5

Section 2 - Third Parties 10

Section 3 - Personal Accident Cover 13

Section 4 - Hospital Benefits 15

Section 5 - Breakdown Assistance 16

Miscellaneous Provisions 17

General Exceptions 18

Conditions 20

Endorsements 21

General Information 24

What to do after an accident 25

Driving in Spain 27

Seguro en España 28

Data Protection Act 29

UK EU Exit Arrangements 33

Camper Insurance

Policy Document

2

Your Policy

Welcome to your policy. This document and

any endorsements that are included in it

sets out the rights and responsibilities of

both you, and us.

The cover you have bought has many

benefits to provide you with peace of mind.

However, as with all insurance contracts,

there will be circumstances where cover

will not apply. These are detailed in

this document.

Please read your policy carefully and keep it

in a safe place.

Your policy is in three parts:

the proposal form and declaration

the policy wording in this booklet

the current Certificate which gives details

of who may drive and the purposes for

which your vehicle may be used

AXA Insurance dac (hereinafter called

the company) will provide insurance as

described in the following pages for injury,

loss or damage happening during the period

of insurance or any subsequent period which

may be agreed anywhere

in Northern Ireland, Great Britain, Republic

of Ireland, the Isle of Man or the Channel

Islands (or in transit by recognised sea

transfer not normally exceeding 65 hours

between ports).

On behalf of AXA Insurance dac

Phil Bradley

Chief Executive

AXA Insurance dac

Registered Number: 136155

Registered Office: Wolfe Tone House,

Wolfe Tone Street, Dublin 1.

The law applicable to this contract

You and we are free to choose the law

applicable to this contract. Your policy will

be governed by the law of Northern Ireland

unless you and we have agreed otherwise.

3

camper insurance

Caring for you

• For a complaint about your policy, contact your Broker or AXA on 0345 399 5346

• For a complaint about your claim, contact our claims action line on 0345 828 2823

• If we cannot sort out your complaint, you can contact our Customer Care Department on

0800 0391970 or: email: [email protected] or: write to AXA Insurance, Customer

Care Department, Freepost BEL 2531, Belfast, BT1 1BR.

If you are unhappy with the way we have dealt with your complaint, you may be able to

refer to:

The Financial Ombudsman Service,

Exchange Tower, London, E14 9SR

Financial Ombudsman Service -

Customer helpline

Monday to Friday - 8am to 8pm

Saturday - 9am to 1pm

0800 023 4 567 - calls to this number are normally free for people ringing from a “fixed line”

phone - but charges may apply if called from a mobile phone

0300 123 9 123 - calls to this number are charged at the same rate as 01 or 02 numbers on

mobile phone tariffs.

These numbers may not be available from outside the UK – so please call from abroad on

+44 20 7964 0500. Email: [email protected]

Our promise to you

• We will reply to your complaint within five working days.

• We will investigate your complaint.

• We will keep you informed of progress.

• We will do everything possible to sort out your complaint.

• We will use feedback from you to improve our service.

Financial Services Compensation Scheme (FSCS)

AXA Insurance dac is covered by the Financial Services Compensation Scheme (FSCS). You

may be entitled to compensation in the unlikely event we cannot meet our obligations to you.

This depends on the type of insurance, size of the business and the circumstances of the

claim. Further information about the compensation scheme arrangements is available from

the FSCS (www.fscs.org.uk).

camper insurance

4

Definitions

We/us/the company

means AXA Insurance dac.

vehicle

means any camper for which there is in force an effective certificate of motor insurance

issued under the policy.

you/your/the insured

the person named as insured on the schedule.

Camper means

a Vehicle owned by the insured built or adapted to provide sleeping accommodation and

cooking facilities, including all fixtures and fittings but excluding other contents.

Motoring accessories

means an item or piece of equipment designed for use in conjunction with a motor vehicle

but not specifically for a camper.

The Continent of Europe

includes any country in or outside Europe whose Green Card Bureau is a member of the

Council of Bureaux in London.

5

camper insurance SECTION 1

Section 1 - Loss of or Damage to your camper

This section applies only to a camper notified to and accepted by the company.

Section 1 (A) Comprehensive

The company will pay for accidental loss of or damage to your camper, its motoring

accessories and specific items as shown below while they are in or on your camper or in your

own private garage.

Excess

Except for the items listed under “Specific Items” below, You will be required to pay the first

£100 of any claim under Section 1 (A). A separate excess is shown for the Specific items.

Section 1 (B) Fire & Theft

The company will pay for loss of or damage to your camper, its motoring accessories and

specific items as shown below while they are in or on your camper or in your own private

garage caused by fire, theft or attempted theft.

Your camper must be missing for at least 28 days before the company will consider it lost

by theft.

Looking after your campervan

You must do all you can to prevent injury to other people and protect your campervan and

keep it in a roadworthy condition. If you do not do this, your right to claim under your policy

may be affected. If your campervan is stolen, you must tell us as soon as possible by phoning

our claimshelpline on 03458 282823. You must also tell the Police.

1. Loss or damage caused by theft or attempted theft if the campervan was taken by a

member of your family or household unless you can provide us with written confirmation of

notifying Police of the theft.

2. Loss or damage caused by theft or attempted theft if the keys (or keyless entry system) are

left unsecured or left in or on an unattended campervan.

Section 1 (C) Windscreen

The company will pay broken glass in the windscreen, windows and roof of your camper. The

company will also pay for any scratching to the bodywork of your camper resulting solely and

directly from the broken glass.

Section 1 (D) Fire Brigade Charges

We will pay charges from a local authority (in line with the Fire Services Act 1981) for putting

out a fire in your camper if the fire gives rise to a valid claim under the policy,

or for removing the driver or passengers from your camper using cutting equipment.

The most that we will pay for any one claim is £1,000.

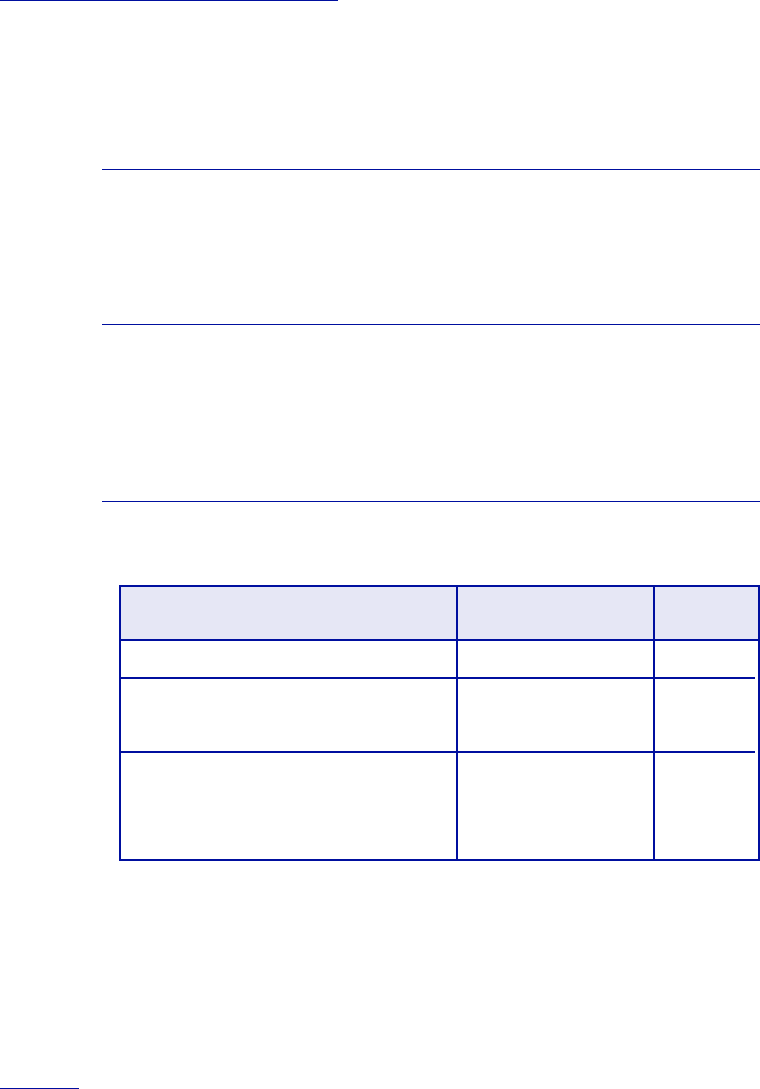

Specific Items

In addition to the camper and its motoring accessories, the following items are covered up to

the maximum amount, less the excess, shown here.

In the event of your campervan not being used for holiday purposes, not in use, or is laid up,

your contents cover for personal belongings will be reduced to £450. We will provide cover up

to £450 for items that are lost or damaged caused by accident, fire, theft or attempted theft.

camper insurance SECTION 1

6

Item Maximum amount Excess

payable

Awnings attached to your camper £1,800 £80

Portable electricity generating

equipment in, on or connected £950 £80

to your camper

Contents of your camper

including clothing, personal £4,000 £80

effects, luggage and pedal

cycles, while in your camper

7

camper insurance SECTION 1

Pedal Cycles Theft Cover

This cover is designed to cover pedal bikes that might be stolen from your camper. It only

applies to cases where the bike was securely locked to a bicycle rack attached to the camper

at the time of the loss.

This cover is limited to £425 per total claim in any one insurance year. This may relate to

multiple incidents or to the theft of several bikes.

• Limit per bike £170

• An excess of £45 per claim will apply.

Replacement Car

If your camper is disabled as a result of an incident that will give rise to a valid claim under

this policy, we will at our option provide or arrange to provide you with a replacement car or

pay up to £20 per day incurred by you in hiring a replacement car. The company will decide

how long this benefit is payable for up to a maximum of 35 days.

Temporary use on the Continent of Europe

Section 1 of your policy also operates while your camper is on the Continent of Europe (or

in transit by sea between any port therein). The company will pay any customs duty you are

required to pay as a result of an accident covered by this policy.

What does the company pay?

The word ‘pay’ means that the company may, at its option, make a payment in cash of the

amount of loss or damage, or may repair, reinstate or replace.

If the company knows that your camper is the subject of a hire purchase or leasing

agreement, any cash payment may be made to the owner named in it (whose receipt will be a

full and final discharge).

The company will not pay more for a claim than the market value of your camper immediately

prior to the loss or damage.

The company will not pay more than the manufacturer’s current list price (plus the

reasonable cost of fitting) for any part or motoring accessory.

If the company settles a claim as a total loss, the company reserves the right to own

the salvage.

camper insurance SECTION 1

8

Repairs, storage, collection and delivery

You may authorise repairs, provided such repairs are economical and an estimate is sent

immediately to the company.

A maximum limit of £150 will operate for all fees connected with towage and storage of your

campervan provided you notify us of any accident or loss within 48 hours. If you notify us

after 48 hours we will determine the amount we deem reasonable to pay you for these fees.

If your camper is disabled, the company will pay the reasonable cost of protection and

removal to the nearest competent repairers.

After it has been repaired the company will pay for the reasonable cost of delivery of your

vehicle to your address in the Northern Ireland.

These costs will only be paid in connection with a valid claim for loss or damage.

Where an excess applies payment of this is your responsibility.

9

camper insurance SECTION 1

Exceptions

The company will not pay for:

- Losses you sustain through not being able to use your camper (including the cost of hiring

another vehicle)

- Depreciation

- Wear and tear

- Repairs or replacements which improve your vehicle beyond its condition before the loss

or damage

- Mechanical or electrical breakdowns, failures or breakages

- The company will not pay for the item which broke down, failed or broke but the

company will pay for any consequent loss or damage which is covered, except that

caused by a failure of portable electricity generating equipment

- Damage to tyres caused by applying the brakes, road punctures, cuts or bursts

- Loss or damage resulting from the use of your vehicle in a rally, competition

or trial.

- Loss or damage to anything in or on your vehicle other than its motoring accessories,

spare parts and specific items shown above

- The cost of importing parts or accessories from outside the EU

- Any additional cost of parts or accessories above the price of similar parts available from

the Manufacturer’s European representatives.

In respect of the specific items above and in addition to all other exceptions

- loss or damage caused by any gradually operating cause wear and tear

- losses caused by a failure to maintain equipment in efficient working order

- contents of your camper if they are stolen while the camper was left unlocked

- contents of your camper consisting of

- money, stamps, tickets, documents, securities, (financial certificates such as shares

and bonds), furs or jewellery

- tools, equipment, goods or samples or

anything carried in connection with any trade or business

- business or property insured by another insurance policy; or any article insured under any

other insurance whether effected by you or not

- Satellite Navigational Equipment unless fitted by the Manufacturer or

- Authorised Dealer as original equipment for the vehicle

camper insurance SECTION 2

10

Section 2 - Third Parties

Third Party Bodily Injury

The company will insure the people insured against legal liability (and the associated costs

below) for damages in respect of death of or bodily injury to any person as a result of an

accident involving your camper.

Third Party Property Damage

The company will insure the people insured against legal liability (and the associated costs

below) for damages in respect of damage to property, subject to the following limitations,

as a result of an accident involving your camper

i. The maximum amount we will be liable for is £20,000,000, including the associated

costs below.

ii. If this policy covers more than one person, this maximum amount is the aggregate

amount to be paid and you will have priority over any other people insured.

iii. In dealing with a claim or series of claims arising from one event, the company may

choose to pay you the full amount of this limit less any amounts already paid or any

less amount for which such claim or claims can be settled. The company will then take

no further part in the handling or settlement of a claim, except to pay legal costs and

expenses incurred in respect of matters prior to the date of such payment.

People insured

(a) You

(b) Any person allowed to drive by the Certificate

(c) Any person using (but not driving) your camper with your permission for

social, domestic and pleasure purposes

(d) If you wish, any person (other than the driver) in your camper, or getting into or

out of it

(e) The personal representative of any person in (a) to (d) following that person’s death

(but only in respect of the deceased’s liability)

(f) Any person using your camper in respect of liability under the Road Traffic Act to pay for

emergency treatment.

11

camper insurance SECTION 2

Costs

1 Costs and expenses recoverable by any claimant

2 All other costs and expenses

3 Solicitor’s fees for representation at the coroner’s inquest or fatal inquiry or Court of

Summary Jurisdiction

4 The cost of defence up to a maximum of £1,000 against a charge of manslaughter or

dangerous driving causing death or serious bodily injury.

2,3 and 4 must be incurred with the written agreement of the company.

Temporary Use on the Continent of Europe

Section 2 applies while the vehicle is on the Continent of Europe (or in transit by sea between

any ports therein).

Exceptions to Section 2

The company does not cover

- Damage to property belonging to, or held in trust by, or in the custody or control of,

the person insured

- Damage to any camper being driven or used by a person insured

- Any of the poeple insured in (c) or (d) if to that person’s knowledge the driver of the

camper does not hold a licence to drive it

This exception does not apply if the driver had held such a licence and is not disqualified

from holding or obtaining one

- Any person other than you who has insurance under another policy

- Any person in the Motor Trade driving the vehicle for overhaul upkeep or repair

- Any person insured who does not comply with the terms, exceptions and conditions

of the policy

- Death of or bodily injury to any person driving or in charge of the vehicle.

If the law requires the company to pay a claim which would otherwise not be covered,

we reserve the right to recover the amount from you.

Section 3 - Personal Accident Cover

We will pay the relevant benefits as detailed below in the event that you yoou are killed or

sustain bodily injury as a result of an accident :

1. While traveling in or on, including getting into or out of:

a) Any Road Vehicle (excluding Motor Cycles, Tractors, Combines and Farm Implements

but including Pedal Cycles, whether motor assisted or not) as a passenger or driver.

b) Any Boat or Railway Train as a fare paying passenger

2. In connection with a Railway Train or Road Vehicle in which you are involved as

apedestrian.

Benefits Payable

Section A – Death

Where death is as a direct result of the accident, occurring within twelve calendar months

from the date of the accident

Section B – Permanent Disablement

Total loss by physical separation at or above the wrist or ankle of at least

• one hand

• or one foot

• or total and irrecoverable loss of all sight in one eye

Occurring within twelve calendar months from the date of the accident

Section C – Temporary Total Disablement

In consequence of which you are immediately following the injury and continuously thereafter

entirely incapacitated from attending to any business or following any occupation as a direct

result of the accident.

camper insurance SECTION 3

12

Section Benefit

A £30,000

B £30,000

C, per week £75

13

camper insurance SECTION 3

Exceptions

We will not pay benefit:

• for death that is not a direct result of the accident

• for suicide or attempted suicide or intentional self injury or you being in a state

of insanity

• for your own criminal act

• for any physical defect or infirmity

• for pregnancy or childbirth

• if you are engaging in or taking part in racing or speed testing

• where death is sustained whilst you are under the influence of alcohol or drugs

Provisos

a) Compensation under Section C shall only be payable if :

i. Notification of a claim under this section is made to us within 28 days of the date of

occurrence and

ii. You immediately attend a duly qualified Medical Practitioner and commence suitable

treatment.

Payment will be made only in respect of the period during which you are undertaking

medical treatment. Inability to take part in sports or pastimes will not, of itself, constitute

total disablement.

b) Compensation will not be paid :

i. Under more that none of Sections A or B

ii. Under Section C for any disablement for which compensation is payable under

Sections A or B.

If a claim arises under Section A or B this section will cease to operate from the date

of the accident.

iii. Under Section C, until the total amount payable is agreed, and not from more than

156 weeks in respect of any one accident.

c) If you make a claim under Section C, and subsequently make a claim under Section A or

B in respect of the same injury, the maximum amount payable under this section will be

that payable in respect of Section B.

camper insurance SECTION 3 & 4

14

Conditions

1. You must give us immediate notice of any accident which causes disablement that is

within the meaning of this section, and you must place yourself in the care of a duly

qualified Medical Practitioner and commence suitable treatment.

2. We must be given immediate notice of death resulting or alleged to result from an

accident within the meaning of this section.

3. We will not pay any compensation unless our Medical Adviser(s) are allowed as often

as they require to medically examine you.

Section 4 - Hospital Benefits

If you are hospitalised for more than 6 consecutive days as a result of a road traffic accident

involving your vehicle, we will pay you an amount of £190 per week or part thereof while you

are hospitalised, up to a maximum of 20 weeks.

We will not pay where death or injury is :

• sustained while you are under the influence of intoxicating liquor or drugs.

• consequent upon suicide or attempted suicide.

• otherwise intentionally inflicted.

15

camper insurance SECTION 5

Section 5 - Breakdown Assistance

AXA Assistance (Ireland) Ltd operates the 24 hour motoring assistance helpline. Their registered

office is Kilmartin N6 Retail Park, Athlone, Co. Westmeath, Ireland

To avail of the benefits provided by this endorsement you must use the number 0345 873 4435

(or +353 906 486335 if calling from abroad). Any expenses incurred prior to or without calling this

number will not be covered.

What is covered:

AXA Assistance (Ireland) Ltd will arrange the dispatch of a Motor Trade Professional (MTP) to the site

of breakdown or accident. The cost of this callout is covered. In the event of breakdown, the MTP will

attempt to get the vehicle mobile, and the cost of up to one hours labour to achieve this is covered.

Events covered:

• electrical or mechanical breakdown;

• the campervan does not start;

• accident or fire;

• theft, attempted theft or malicious damage;

• punctures where you need help to replace or repair a wheel;

• loss or theft of keys;

• breakage of keys in the lock, or keys locked into the campervan; or

• loss of, or running out, of fuel.

Our network of service providers are capable of towing most campervan vehicles including large

vehicles up to 8.5 metres in length and 7 tonnes gross vehicle weight. If in the opinion of our local

service provider, it is possible to tow your vehicle and you require a tow we will cover the cost of towing

to either the nearest competent repairer or to any other chosen location (including repatriation) up to a

maximum of £450 for any one incident and £1300 per policy year. If the vehicle is too large to tow we

will cover the cost of an additional one hour’s labour attempt to get the vehicle mobile.

Please note under French Law we can not assist on French Motorways. You will need to contact the

Police if you breakdown on a French Motorway.

The following countries are covered:

Andorra, Austria, Belgium, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany,

Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway,

Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom and the Vatican City.

Please ensure you have your policy book with you when travelling abroad.

camper insurance SECTION 5 / MISCELLANEOUS PROVISIONS

16

Hotel Accommodation

If it is not immediately possible for you to continue your Journey or return to your address

we will pay the cost of one night’s bed and breakfast accommodation for the Driver and

passengers while waiting for your Campervan to be repaired. The maximum amount we will

pay arising from any one incident is £350 and up to £800 per policy year.

Exceptions

We will not be liable:

• Losses of any kind that come from providing, or delaying providing, the services this cover

relates to. (For example, a loss of earnings, the cost of food and drink and costs we have

not agreed beforehand.)

• To pay for expenses which are recoverable from any other source.

• For any claim where your camper is carrying more passengers or towing a greater weight

than that for which it was designed as stated in the manufacturer’s specification.

• For any claim arising out of unreasonable driving of the vehicle on unsuitable terrain.

• For any accident or breakdown brought about by an avoidable, wilful and deliberate act

committed by you.

• For the cost of repairing the vehicle except as outlined above.

• For the cost of any parts, keys, lubricants, fluids or fuel.

• For any claim caused by fuels, mineral essences or other flammable materials, explosives

or toxins transported in the campervan.

• For any breach of this section of the policy or failure on our part to perform any obligation

where such failure is beyond our reasonable control.

• Any claim where the vehicle is not a campervan.

• If you agree to a temporary roadside repair, you will be responsible for any costs or any

damage to the vehicle it suffers if you continue to drive the vehicle as if a permanent

repair had been carried out. You acknowledge that a temporary roadside repair is aimed

only to allow you to drive the vehicle to a suitable facility so a permanent repair can be

carried out.

Conditions

• No benefit shall be payable unless we have been notified through the emergency phone

number of 0345 873 4435 (within Northern Ireland) or +353 906 486335

(to Northern Ireland from Abroad)

• In the event of theft or attempted theft of your camper, the theft must be reported to the

local Police station as appropriate.

• Your policy number must be quoted when calling for assistance.

• Any parts, including the battery, found to be defective

17

camper insurance GENERAL EXCEPTIONS

Miscellaneous Provisions

Avoidance of certain terms and right of recovery

Nothing in the policy or any endorsement will affect the right of any person to obtain payment

of a sum of money which the company is obliged to pay by reason of the law of any country

in which the policy operates relating to the insurance of liability to third parties. However, you

must repay to the company any amount paid which would not have been payable but for the

provisions of such law.

General Exceptions

Applicable to all sections of the policy.

The Company shall not be liable in respect of:

1. Any injury, loss or damage occurring while your vehicle is being:

(a) Driven by any person not covered by the certificate of motor insurance.

(b) Used for any purpose not covered by the certificate of motor insurance.

(c) Driven by you, unless you hold a licence to drive such a vehicle or have held and

are not disqualified from holding or obtaining such a licence.

(d) Driven with your permission, by any person who to your knowledge does not hold a

licence to drive such a vehicle unless such person has held and is not disqualified

from holding or obtaining such a licence.

(e) Driven by any person who does not comply with the terms exceptions and

conditions of the policy.

(f) any claim under any section of the policy if the camper van is used as a permanent

residence or an extension of your permanent residence, as the Dolmen camper van

scheme is specifically designed to cover camper van’s used for holiday purposes

only.

2. Any liability which attaches by virtue of an agreement but which would not have

attached in the absence of such agreement.

3. (a) Loss or destruction of or damage to any property

whatsoever or any loss or expense whatsoever resulting or arising therefrom or any

consequential loss or

(b) Any legal liability of whatsoever nature directly or indirectly

caused by or contributed to by or arising from:

(i) Ionising radiations or contamination by radioactivity from any irradiated

nuclear fuel or from any nuclear waste from the combustion of nuclear fuel.

(ii) The radioactive toxic explosive or other hazardous properties of any explosive

nuclear assembly or of its nuclear components.

camper insurance GENERAL EXCEPTIONS

18

4. Liability loss damage cost or expense of whatsoever nature directly or indirectly caused

by resulting from or in connection with any of the following regardless of any other

cause or event contributing concurrently or in any other sequence to the loss (except so

far as is necessary to meet the requirements of Road Traffic Legislation):

(a) War invasion acts of foreign enemies hostilities or warlike operations (whether

war be declared or not) riot civil war mutiny civil commotion military rising

insurrection rebellion revolution military or usurped power martial law confiscation

or nationalisation or requisition by or under the order of any Government or public

or local authority

(b) Any act of terrorism

For the purpose of this exception an act of terrorism means an act including but

not limited to the use of force or violence and/or the threat thereof of any person

or group(s) of persons whether acting alone or on behalf of or in connection with

any organisation(s) or government(s) committed for political religious ideological

or other purposes including the intention to influence any government and/or to

put the public or any section of the public in fear

This exception also excludes liability loss damage cost or expense of whatsoever

nature directly or indirectly caused by resulting from or in connection with any

action taken in controlling preventing suppressing or in any way relating to (a)

and/or (b) above If the Company alleges that by reason of this exception any

liability loss damage cost or expense is not covered by this insurance the burden

of proving to the contrary shall be upon the Insured In the event any portion of this

exception is found to be invalid or unenforceable the remainder shall remain in

full force and effect.

5. Any injury, loss or damage (except under Section 2 of the Policy) caused by Earthquake.

6. Any accident, injury, loss, damage or liability (except so far as is necessary to meet the

requirements of Road Traffic legislation) while your vehicle is in or on any part of an

aerodrome, airport or airfield provided for:

(a) The take-off and landing of aircraft and for the movement or parking of aircraft on

the ground.

(b) Service roads, ground equipment, parking areas and those parts of passenger

terminals coming within the Customs examination area.

7. Liability loss damage cost or expense of whatsoever nature directly or indirectly caused

by resulting from or in connection with:

(a) The loss of alteration of or damage to or

(b) A reduction in the functionality availability or operation of

19

A computer system hardware programme software data information repository

microchip integrated circuit or similar device in computer equipment or non-computer

equipment whether the property of the Insured or not that results from the malicious

or negligent transfer (electronic or otherwise) of a computer programme that contains

any malicious or damaging code including but not limited to computer virus worm logic

bomb or trojan horse.

This Policy does not apply

1. If campervan is being used for purposes that are not shown in your certificate of

insurance

2. Is being driven by, or in the charge of any person who is not covered by your certificate

of insurance

3. Is being driven by you and you have not got a licence, or if you have had a licence, are

disqualified from driving or getting a licence

4. Is being driven with your permission by any person who you know has not got a driving

licence or who you know to be disqualified from driving or getting a licence.

If an accident happens and:

(a) As a result you and any insured person is convicted or has a prosecution pending

of an offence involving alcohol or drugs:

(b) You or any person is driving while unfit to do so due to alcohol or drugs;

or

(c) you or any insured person is driving after drinking alcohol and, three hours after

the accident, the amount of alcohol in the breath, blood or urine is above the legal

limit for driving.

Then

(a) The cover provided under the loss of or damage to the insured campervan will not

apply,

(b) you or any person driving must repay all the amounts we have paid to cover any

claims arising from the accident,

(c) This policy does not cover anyone who does not meet the policy terms and

conditions,

(d) This policy does not cover any liability which you have as a result of an agreement

or contract, unless you would have had that liability anyway.

camper insurance GENERAL EXCEPTIONS

camper insurance CONDITIONS

20

Conditions

1. Claims procedure

In connection with any injury loss or damage which may give rise to a claim under

the policy

• You must contact AXA on 03458 282823

• In the event of an incident such as accident, injury, loss or damage involving the insured

campervan which could lead to a claim, You must immediately do whatever you can to

protect your campervan and its accessories. You or your legal representative must give us

full details by phoning the claims helpline

• You must send to the Company immediately any writ or summons, and as soon as

possible any letter, claim or other document unacknowledged.

• You must notify the Company immediately of any impending prosecution, inquest or

fatal inquiry.

• You must not admit liability for or negotiate the settlement of any claim without the

Company’s written agreement.

• You must give the Company all information and assistance required.

The Company is entitled to take over and conduct the defence or settlement of any claim,

and to pursue any claim for its own benefit in the name of any person insured. However, the

Company does not have to do so.

2. Looking after your camper

You must take all reasonable precautions to

(a) Prevent injury, loss or damage

(b) Maintain your camper in an efficient and proper roadworthy condition

(c) Ensure your camper and its motoring accessories and specific items are free from

any defect.

The Company shall have at all times free access to examine your camper.

3. Other Insurance

If any loss or damage is covered by any other insurance, the Company will not pay more than

its rateable proportion, except as otherwise stated in the policy.

4. Changes to your policy

You must tell the company immediately of

- Any change of camper

- Any convictions or pending prosecutions

- Any change in driver’s health

- Any change in address or occupation

- Any change or modification of the camper

- Any additional camper

- Any change in use

- Any change in main user

- Any change in any other material fact

5. Cancellation

The Company may cancel the policy by sending 7 days notice by registered letter to

you at your last known address. In such event we may return a proportionate part of

the Premium, provided the certificate has been returned. You may cancel the policy by

returning the certificate to the Company with a written instruction to cancel.

If you cancel within the first 12 months of the policy we will not refund your premium.

If you have had continuous cover for more than 12 months, we will work out the percentage

of premium for the period you have been insured and refund any balance after an

administration fee has been taken away.

If you have made a claim or there has been any incident that is likely to result in a claim

during the current period of insurance, we will not refund your premium.

6. Suspension

There is no refund if your campervan is laid up and/or out of use.

7. Fraud

You must not act in a fraudulent manner. If you or anyone acting for you:

• Fails to disclose or conceals a fact likely to influence the assessment or acceptance of

a proposal, a renewal, or any adjustment to the policy or

• Fails to disclose or conceals a fact likely to influence the provision of indemnity or the

extent of indemnity provided by the company or

21

camper insurance CONDITIONS

camper insurance CONDITIONS

22

• Makes a statement to the company or anyone acting on the company’s behalf knowing

the statement to be false in any respect or

• Submits a document to the company or anyone acting on the company’s behalf knowing

the document to be forged or false in any respect or

• Makes a claim under the policy knowing the claim to be false or fraudulently exaggerated

in any respect or

• Makes a claim in respect of any loss or damage caused by your willful act or with your

connivance

then and in addition to any other rights or remedies which the company may have under this

Policy or otherwise the Company:

• will not pay a claim

• will not pay any other claim which has been or will be made under the policy

• may at the Company’s option declare the policy void

• will be entitled to recover from the Insured the amount of any claim already paid under

the policy

• will not make any return of premium

• may inform the appropriate law enforcement authority of the circumstances

8. Arbitration

Any difference arising under the policy shall be referred to Abitration in accordance with the

statutory provisions then being in force and the making of an Award shall be a condition

precedent to any right of action against the Company. Any claim for which the Company

disclaims liability and which has not within a year of such disclaimer been referred to

arbitration shall be deemed to have been abandoned and not recoverable thereafter.

9. Observance of policy conditions

The policy cover will only operate if its terms, provisions, conditions and endorsements are

complied with and the statements and answers in the proposal forms or information given

orally and outlined in the proposal confirmation, which forms the basis of the contract are

complete and correct.

23

camper insurance ENDORSEMENTS

Endorsements

Trailers

The Company will indemnify you in the terms of Section 2, Third Party, in respect of liability

arising while any trailer or caravan, details of which have been supplied to the company, is

detached from any vehicle insured under this policy.

The company does not cover any liability if the trailer or caravan is attached to a vehicle

which is not covered by this policy.

Endorsement 6205 Extra Benefits

Your schedule will show if you have chosen this cover which is available at an

additional charge.

This package gives you additional cover as outlined below.

• External Motor Bike Rack limit £850

• Crash Bar limit £200

• Tow Bar limit £425

• Solar Panels limit £850

• Satellite Systems limit £2,000

What is not covered:

• An excess of £100 applies to this extended cover.

• This cover only applies to purpose built camper vans that are less than 10 years old.

camper insurance GENERAL INFORMATION

24

General Information

Moving home?

Please bear in mind that the company needs to have your current address. This will make

sure that your renewal invitation will reach you in good time and avoid confusion in the event

of a claim.

Change of camper?

You are reminded of Condition 3 of the policy. Cover applies only to the camper notified

to and accepted by the company. If you get a new vehicle or an additional vehicle you

must supply the company with full particulars if you want cover for it. You may need

a new Certificate.

Other Changes?

The policy cover is based on the details you supplied on the proposal form.

Hence it is important that any subsequent alterations to these details should be notified

to us without delay.

25

camper insurance GENERAL INFORMATION

What do you do after an accident

This page is for your assistance and does not form part of the policy.

Note the registration number of the vehicles involved.

Ask for the names and addresses of other people involved and any witnesses.

Make a sketch plan of the scene of the accident.

Do not admit responsibility or sign any statement to this effect.

If the accident results in damage to another vehicle, an animal, or other property, to comply

with the law you must

- stop

- give your name, address and registration particulars of the vehicle (along with the owner’s

name and address) to anybody reasonably requiring the information.

If anyone other than yourself is injured you must show your Certificate to the Police or to any

other person reasonably asking. If you cannot do this at the time of the accident, report the

accident to the Police as soon as possible and in any case within 24 hours.

You must also show your Certificate to any person reasonably asking, if you have caused

damage to another vehicle or property.

Getting your camper repaired

If the damage is covered by your policy

- please arrange to remove your vehicle to the nearest competent repairer and ask for an

estimate to be sent to the company as soon as possible.

Excess

Where a damage claim is subject to an excess, it is the company’s practice to instruct the

repairer to collect the excess from you directly, when the repair is complete.

camper insurance GENERAL INFORMATION

26

Telling the Company

Complete and send an accident report form as soon as possible. If you do not have one, they

can be obtained from your broker or local office of the company.

Prosecutions

You must let the Company know at once if you receive notice of any intended prosecution as

a result of the accident.

It would also help the Company as your insurers to know if other parties involved in the

accident are to be prosecuted. Please tell the Company.

Claims made against you by other persons

Send all letters and other correspondence to the company as quickly as possible so that the

company can deal with them on your behalf.

Do not admit liability for the accident or make any offer of payment.

In your own interest, you should contact the company if you are asked to give a statement

to anyone.

Stolen campers

Please notify the Police, as soon as the loss is discovered.

If the vehicle is not recovered the company will negotiate settlement of your claim on the

basis of the market value in accordance with the policy.

27

camper insurance INSURANCE IN SPAIN

Insurance in Spain

This policy insures the person or persons named in section 4 of the certificate of motor

insurance for the period shown in that certificate against LIABILITY TO THIRD PARTIES

as follows:

• Unlimited indemnity against liability at law for damages and claimants’ costs and

expenses in respect of death of or bodily injury to any person (including passengers)

where such death or injury or such damage arises out of an accident caused by or in

connection with the vehicle described and specified in section 5 of the said certificate.

• An amount of not more than £20,000,000 in respect of damage to property where such

damage arises out of an accident caused by or in connection with the vehicle described

and specified in section 5 of the said certificate.

We authorise:

AXA SEGUROS

Paseo De La Castellana, 79

28046 Madrid

to make such guarantees or deposits as may be necessary but not exceeding £1,500 in order

to obtain the release of the vehicle and / or the Insured and / or the persons authorised

to drive the vehicle from official detention following an accident which is or might be the

subject of indemnity under the foregoing Third Party Insurance and to accept service of

legal proceedings and to handle and eventually settle on our behalf all claims under this

insurance.

Insurer / Asegurador: AXA Insurance dac, Wolfe Tone House, Wolfe Tone St., Dublin 1,

Ireland. Tel: 00353 1 8583470 Fax 00353 1 8721633

Note: If any part of this guarantee or deposit is wholly or partly forfeited, or is taken for

payment in fines or costs, you are liable to repay that amount to the company.

28

Seguro en España

La póliza asegura a la persona o personas mencionadas en la sección 4 del certificado

del vehículo asegurado por el periodo mostrado en el certificado. Riesgo a terceros

como sigue:

• Indemnización ilimitada de la obligación en la ley por los daños y perjuicios y costes

de los demandantes y gastos con respecto a la muerte o la lesión corporal a cualquier

persona (incluyendo pasajeros) y daños a la propiedad donde tal muerte o lesión

o tal daño surgiese del accidente causado o en relación con el vehículo descrito y

especificado en la sección 5 de dicho certificado.

• Una cantidad de no mas de £20.000.000 con respecto a los daños a la Propiedad

donde tal daño surgiese del accidente causado por o en conexióncon el vehículo descrito

y especificado en el certificado en la sección 5.

Autorizamos:

AXA Seguros

Paseo De La Castellana, 79

28046 Madrid

para hacer tales garantías o depósitos necesarios no excediendo £1,500 para obtener

la libertad del asegurado o de su vehículo y/o las persona autorizadas para conducir dicho

vehículo de detención oficial que sigue un accidente que es o podría ser el asunto de

indemnización bajo seguro procedente a Terceros y aceptar servicio o procedimiento judicial,

administrar y liquidar en nuestro nombre todas las demandas baja este seguro.

Insurer / Asegurador: AXA Insurance dac, Wolfe Tone House, Wolfe Tone St., Dublin 1,

Ireland. Tel: 00353 1 8721000 Fax 00353 1 8721633

Note: If any part of this guarantee or deposit is wholly or partly forfeited, or is taken for payment in fines or costs,

you are liable to repay that amount to the company.

camper insurance SEGURO EN ESPAÑA

29

camper insurance DATA PROTECTION NOTICE

Data Protection Notice & Privacy Statement

Data Protection

AXA considers that protecting personal information including sensitive personal information,

is very important and we recognise that you have an interest in how we collect, use and

share such information. This information will be processed in accordance with Data

Protection Acts and principles and in compliance with any code(s) of practice issued by the

Data Protection Commissioner or IIF (Irish Insurance Federation). We invite you to review this

Data Protection Statement, which outlines how we use and protect that information.

References to “AXA” means AXA Holdings Ireland Limited, and its subsidiaries including

AXA Insurance dac and any associated companies from time to time. The information

that you provide to AXA will be held on a computer, computer database, e-mail, imaged

documents, files, telephone recording, CCTV and letter and/or in any other way.

Use of information

AXA will use this information to (i) administer and process any products /services you

have purchased from us, (ii) administer any future agreements we may have with you,

(iii) manage any claim notified by you or by a third party and (iv) for client services, research

and statistical analyses. When considering a proposal or administering your insurance

contract(s), handling claims, or making decisions regarding deferred payment arrangements,

including whether to continue or to extend an existing deferred payment arrangement, AXA

may carry out searches (for the purpose of verifying your identity and driving experience)

and/or a credit search with one or more licensed credit reference agencies.

Rights of Customers

You have the right of access to the personal data held about you by AXA by sending a written

request to the Data Protection Unit, AXA Insurance dac, Wolfe Tone House, Wolfe Tone

Street, Dublin 1, and on payment of a fee of £5.00. You also have the right to require AXA to

correct any inaccuracies in the information we hold about you.

camper insurance DATA PROTECTION NOTICE

30

Sharing of Information

We shall not disclose personal information without the consent of the individual to which

it relates except in limited circumstances as permitted or required by law. We may share

personal information with agents or service providers in connection with providing,

administering and servicing the products you have purchased from us or in the course of

handling third party claims. Where we choose to have certain services provided by third

parties, we do so in accordance with the applicable law and take reasonable precautions

regarding the practices employed by the service provider to protect personal information.

Other Products and Services

In the future we, AXA, would like to use your personal data for the purpose of offering you

other products and services, including those available from companies in the AXA Ireland

Group and carefully selected third parties, which AXA thinks may be of interest to you. In this

connection, and occasionally for market research and statistical purposes, the services of a

reputable external agency may be used.

If you decide to proceed with this proposal or have any other communication with AXA

through or in relation to its products and services you accept the use by AXA of your personal

data as indicated.

31

camper insurance DATA PROTECTION NOTICE

Claims and Underwriting Exchange Register

Insurers pass information to the Claims and Underwriting Exchange Register, run by the

Insurance Database Services LTD (IDS Ltd) and the Motor Insurance Anti-Fraud and Theft

Register, run by the Association of British Insurers (ABI). The aim is to help us to check

information provided and also to prevent fraudulent claims. When we deal with your request

for insurance, we may search these registers.

It is a condition of the policy that you supply such details of the vehicles whose use is covered

by the policy as are required by the relevant law applicable in Great Britain and Northern

Ireland, for entry on the Motor Insurance Database. Under the conditions of your policy, you

must tell us about any incident (such as accident or theft) which may or may not give rise

to a claim. When you tell us about an incident, we will pass information relating to it to

the registers.

The policy details of customers in Northern Ireland, will be added to the Motor Insurance

Database (MID), run by the Motor Insurers’ Bureau (MIB). MID data may be used by the DVLA

and DVLNI for the purpose of Electronic Vehicle Licensing and by the Police for the purposes

of establishing whether a driver’s use of the vehicle is likely to be covered by a motor

insurance policy and/or for preventing and detecting crime. If you are involved in an accident

(in the UK or abroad), other UK insurers and the Motor Insurers’ Bureau may search the MID

to obtain relevant policy information.

Persons pursuing a claim in respect of a road traffic accident (including citizens of other

countries) may also obtain relevant information which is held on the MID.

You can find out more about this from us, or at www.miic.org.uk.

You should show this notice to anyone insured to drive the vehicle covered under this policy.

32

camper insurance UK EU EXIT ARRANGEMENTS

UK EU Exit Arrangements

In order to protect our customers from uncertainty resulting from Brexit we are making plans

to leverage the wider capabilities of the global AXA group. We have therefore added a new

term to your policy to allow us to automatically transfer the underwriting of your policy from

AXA Insurance dac (an Irish insurer) to AXA Insurance UK Plc (another insurer owned by the

AXA Group and licensed to carry on insurance business in the UK). This transfer would only

operate should, following Brexit, it not be possible for us as an Irish insurer to continue to

cover or enter into insurance policies with residents or companies based in the UK.

What does this mean to you?

This potential change will have no impact on either the service or benefits provided under

your policy, please continue to contact AXA Insurance dac. The same teams will continue to

look after any queries, amendments payments or claims that you may have.

Transfer of your policy when the UK leaves the EU

Your policy is underwritten by AXA Insurance dac, an Irish based insurer. This means that if

your principal country of residence is within the UK it may not be possible for us to continue

legally to meet our obligations under your policy when the United Kingdom leaves the EU

without a provision in our agreement with you to allow us to automatically transfer the

underwriting to AXA Insurance UK Plc.

By entering into this policy you agree that, if we believe that it may not be possible for AXA

Insurance dac to legally meet its obligations under your policy, we may write to you to let you

know that we plan to transfer all of AXA Insurance dac’s rights and obligations under this

policy to AXA Insurance UK Plc. This transfer will take place at 10.59 p.m. on 28 March 2019

or an earlier date which we will specify (the transfer date).

If we write to you to give you reasonable notice of the transfer described above, we will:

• explain the process and any changes to your policy

• give you an option to cancel your policy instead, explaining the process for cancellation

(including what you need to do to choose to exercise the cancellation option as well as

the terms governing the amount that we will refund you).

If we use this transfer right (and you do not choose to cancel your policy instead), then,

on the transfer date, AXA Insurance dac will be replaced by AXA Insurance UK Plc as the

underwriter of this policy. From the transfer date:

33

Section 1

Lega

camper insurance UK EU Exit Arrangements

• AXA Insurance UK Plc will do everything that AXA Insurance dac has agreed to do under

this policy (except anything that AXA Insurance dac has already done by the transfer

date and except for any changes that may be required by law or regulation) as if AXA

Insurance UK Plc was named in this policy as the original underwriter

• AXA Insurance UK Plc will have all the rights that AXA Insurance dac had under this

policy as if AXA Insurance UK Plc was named in this policy as the original underwriter,

including rights to receive payment of any outstanding or regular premiums due and/or

payment of “excess” amounts in relation to claims

• AXA Insurance dac will have no further obligations toward you (including in relation to

things that AXA Insurance dac had agreed to do before the transfer date) and will not

have any rights at all against you or any other interest in this policy

• all authorisations and instructions for the payment of premiums and/or excess to AXA

Insurance dac will take effect as providing for authorisation and instruction for the

payment of premiums and/or excess to AXA Insurance UK Plc

• use of ‘we’, ‘us’ or ‘our’ in this policy will mean AXA Insurance UK Plc and when ‘AXA

Insurance dac’ is used this will mean AXA Insurance UK Plc

• your policy renewal date will remain the same.

This section ‘Transfer of your policy when the United Kingdom leaves the European Union’ will

take precedence over any other part of this policy that is inconsistent with it.

camper insurance NOTES

34

Notes

35

camper insurance NOTES

Notes

AXA Insurance dac, Wolfe Tone Street, Dublin 1. Registered in Ireland

number 136155. We may record or monitor phone calls for training,

prevention of fraud, complaints and to improve customer service. AXA

Insurance dac is regulated by the Central Bank of Ireland. For business

in Northern Ireland, AXA Insurance dac is authorised by Central Bank of

Ireland and authorised and subject to limited regulation by the Financial

Conduct Authority. Details about the extent of our authorisation and

regulation by the Financial Conduct Authority are available from us on

request. AB078 11/18 OMI18369

Arranged by

Camper Careline +353 1 802 2330

For claims assistance 03458 282823

(+44 3458 282823 (from outisde NI)

For breakdown assistance 0345 873 4435

(+353 906 486335 from outside NI)

Dolmen Insurance Brokers Ltd is regulated by the Central Bank of Ireland.